BofA noted long lead times, especially for the base iPhone 17 model, with China leading the way, as consumers in the country take advantage of government subsidies for electronic products, subject to a price cap.

Apple Inc.’s stock struggled to build on the momentum it gained in Monday’s session, trading barely higher in the premarket on Tuesday.

On Monday, Apple’s shares jumped 4.31% to $256.08, with the upside accompanied by nearly double the average volume. The strength is attributable to positive commentary on the iPhone 17 uptake by Wedbush analyst Daniel Ives and BofA analysts.

Ives, who raised his price target for Apple stock to $310 from $270, said demand trends for the new iPhone lineup were strong. The analyst upped his iPhone shipment forecast for the fiscal year 2026, stating that the period of disappointing growth may be over for Apple.

BofA noted long lead times, especially for the base iPhone 17 model, with China leading the way, as consumers in the country take advantage of government subsidies for electronic products, subject to a price cap.

The Apple stock is entering a period of strength. Apple reports the strongest sales performance in the December quarter, which encompasses the key holiday selling period, with the buoyancy also translating to the stock. Incidentally, the stock hit a record high of $260.10 on Dec. 26, 2024.

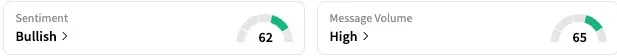

On Stocktwits, retail sentiment toward Apple stock remained ‘bullish’ (62/100) early Tuesday, while the message volume on the stream increased to ‘high.’

A bullish user positioned for a stock move toward the $300 barrier.

Thanks to Monday’s surge, Apple turned to black for the first time this year. Nevertheless, the year-to-date (YTD) gain is a paltry 2.62% even as SPDR S&P 500 ETF (SPY), an exchange-traded fund (ETF) that tracks the S&P 500 Index, and the tech-focused Invesco QQQ Trust (QQQ) have added 14.8% and 18.1%, respectively, for the year.

Apple has also been a laggard among the “Magnificent Seven” Group of mega-cap companies.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<