Analysts see strong support at 25,000 but expect resistance near 25,500 unless earnings or FII flows improve.

Indian equity markets open lower with the Nifty index slipping below 25,200 levels in the weekly expiry session.

At 09:45 a.m. IST, the Nifty 50 traded 54 points lower at 25,148, while the Sensex was down 218 points at 81,941. Broader markets see selling pressure, with the Nifty Midcap and Smallcap indices falling 0.3%.

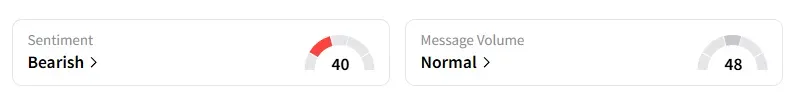

The retail sentiment on Stocktwits for the Nifty has shifted to ‘bearish’ at market open, down from ‘neutral’ on Monday.

Stock Watch

Sectorally, barring auto and metals, the rest of the indices traded in the red, led by FMCG, real estate, and technology.

Maruti was the top Nifty gainer, rising over 2% and Hyundai Motor India gained 1%, driven by a surge in inquiries and deliveries on the first day of Navratri.

KEC International shares surged 7% on securing new transmission and distribution orders worth ₹3,243 crore in the UAE and the US.

JBM Auto gained 4% after its subsidiary JBM Electric Vehicles partnered with the UAE’s Al Habtoor Motors, which will exclusively import and distribute JBM’s electric buses in the region.

Stock Calls

Analyst Vinayak Gautam shared three stock recommendations for Tuesday with a 1-week timeframe:

ACE: Buy at ₹1,146, for a target price of ₹1,180, and stop loss at ₹1,110

JSW Infra: Buy at ₹338, for a target price of ₹355, and stop loss at ₹328

JK Lakshmi Cement: Buy at ₹888, for a target price of ₹915, and stop loss at ₹875

Markets: The Road Ahead

From a technical standpoint, SEBI-registered analysts on Stocktwits shared the trade setup.

Analyst Prabhat Mittal identified Nifty support at 25,080 with resistance at 25,320. For Bank Nifty, he sees support at 55,000 and resistance at 55,600.

Varunkumar Patel stated that the Nifty is likely to trade in the 25,000–25,500 range over the next two weeks. He added that resistance around 25,500 would be difficult to break unless earnings surprise on the positive side or FIIs turn buyers. Support remains strong at 25,000, where domestic inflows and retail participation are providing stability. Defensive and consumption themes may provide relative safety until earnings season begins, Patel concluded.

Investment advisor Nidhi Saxena of Trade Bond believes that short-term pressure may persist, but 25,000 remains a strong support zone for the Nifty, with resistance at 25,500. For Nifty Bank, she recommended buying on dips with a support level of 55,000 (on a closing basis) and resistance at 55,700.

Global Cues

Globally, Asian markets traded mixed, while crude oil prices edged lower amid oversupply concerns and rising geopolitical tensions in the Middle East.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<