The stock had surged 20% on Tuesday due to the anticipation of the iPhone 17 launch.

Shares of Redington, a distributor of Apple products in India, surged over 9% on Friday, following the launch of the iPhone 17 series.

This follows a 20% rally on Tuesday in anticipation of the iPhone launch. The stock had hit its upper circuit limit.

According to NSE data, 572.32 lakh shares changed hands on Friday, with an overall trade value of ₹1,759.78 crore.

iPhone Sales Boost

Apple remains a key growth driver for Redington. According to Redington’s June-quarter investor presentation, Apple accounted for 34% of its revenue, up from 30% in FY25. The company has been distributing Apple products in the country since 2007.

The iPhone 17 lineup is priced between ₹82,900 for the 256 GB base model and ₹1.9 lakh for the premium 1TB iPhone Pro Max.

Q1 Print

Redington reported a 12% rise in Q1 FY26 net profit to ₹275 crore compared with ₹246 crore last year. The company’s June quarter revenue rose 22% to ₹25,952 crore, from ₹21,282 crore a year earlier.

What is the Retail Sentiment?

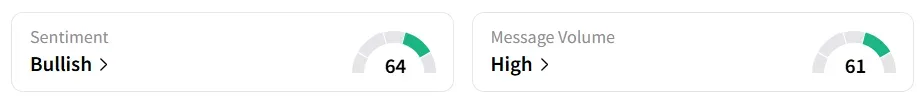

Retail sentiment on Stocktwits remained ‘bullish’. It was ‘neutral’ a week back. Chatter on the platform remained ‘high’.

The stock has seen significant buying interest this year, gaining more than 51% in 2025.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<