India’s market regulator has given Adani Group a clean chit in the high-profile Hindenburg case, saying no evidence of financial fraud or manipulation was found. The order sparked a strong rally across key Adani stocks.

Adani Group stocks surged in early trade on Friday after India’s capital markets regulator gave a clean chit to the conglomerate in a high-profile case triggered by US-based short-seller Hindenburg Research.

Securities and Exchange Board of India’s (SEBI) final orders dismissed allegations of stock manipulation, fund diversion, and accounting irregularities, bringing closure to an investigation that had weighed heavily on investor sentiment for over two years.

Adani Power surged 8.8% to ₹686.95, Adani Enterprises gained 5.1% to ₹2,526, while Adani Ports & Special Economic Zone climbed 1.4% higher to ₹1,433 in early trade.

Hindenburg’s Allegations

Hindenburg’s January 2023 report had accused the conglomerate of inflating stock prices, misusing offshore entities, failing disclosure norms, and engaging in dubious related-party transactions.

The claims sparked a significant erosion in market value across Adani’s listed companies. SEBI subsequently launched an extensive inquiry into the group’s practices to determine whether there were breaches of securities laws, including rules under the SEBI Act, LODR (Listing Obligations and Disclosure Requirements), and PFUTP (Prohibition of Fraudulent and Unfair Trade Practices).

The regulator examined financial and transactional records of multiple Adani entities over several years. Among the firms scrutinized were Adicorp Enterprises, Milestone Tradelinks, and Rehvar Infrastructure, covering financial periods ranging from FY 2012–13 to FY 2022–23.

SEBI’s review focused on loans, related-party linkages, and shareholding structures to assess whether investors were misled or harmed.

SEBI’s Assessments

SEBI concluded that the allegations were not substantiated. It observed that loans flagged in the Hindenburg report had been fully repaid with interest before the probe began.

The regulator also noted that many of the transactions under question did not fall under the category of related-party dealings requiring disclosure or shareholder approval and found no evidence of fund siphoning, stock price manipulation, or misrepresentation in financial statements.

As a result, the regulator dismissed charges against Gautam Adani, his brother Rajesh Adani, CFO Jugeshinder Singh, and flagship companies, including Adani Enterprises, Adani Ports & SEZ, and Adani Power.

Gautam Adani’s Response

Responding to the order, Gautam Adani said the findings vindicated the group’s long-held position that the allegations were baseless. In a post on X, he expressed regret over the losses investors had to bear during the turmoil caused by the short-seller’s claims.

Analyst Take

SEBI-registered investment advisor Nidhi Saxena of The Trade Bond identified key levels for Adani stocks, pegging Adani Enterprises’ support at ₹2,350-₹2,280 and resistance at ₹2,500– 2,600.

For Adani Ports, she sees support at ₹1,380 – ₹1,350 with resistance at ₹1,450 – ₹1,500, while Adani Power shows support at ₹610 – ₹590 and resistance at ₹650 – ₹670.

She maintained a positive near-term bias, noting that a sharp rally could follow if resistance levels are breached on strong volumes. However, she cautioned that the news may also attract momentum traders and recommended that institutional investors slowly rebuild exposure.

Stock Watch

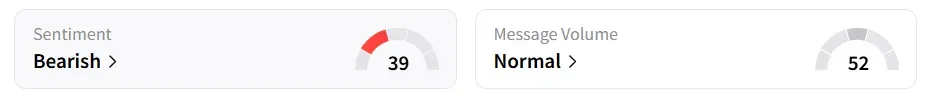

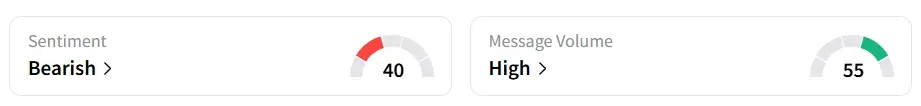

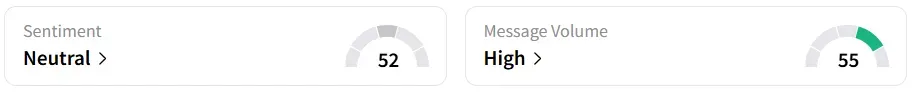

Retail sentiment for Adani Ports, Adani Power, and Adani Green Energy was ‘bearish’ ahead of market open on Friday. Sentiment for Adani Enterprises was ‘neutral’, but it was ‘bullish’ a week earlier.

YTD, Adani Ports has gained 15.1%, and Adani Power has added 20.4% in the stock’s value. Adani Enterprises and Adani Green Energy shares have declined over 5% each.

Adani Ports, Adani Power, and Adani Enterprises were among the top 10 trending stocks on Stocktwits.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<