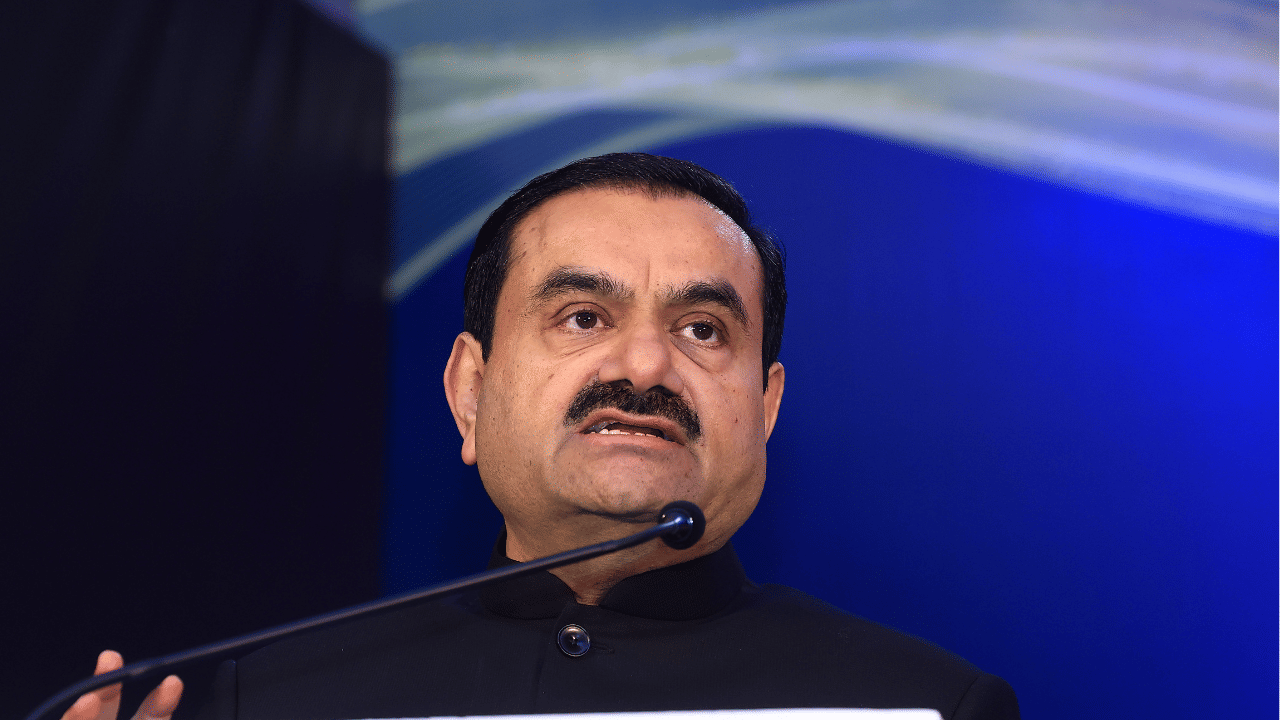

New Delhi: SEBI (Securities and Exchange Board of India) on Thursday, September 18, gave a clean chit to Adani Group on the fraud allegations leveled on it by the US short seller Hindenburg Research. SEBI, in its orders, clarified that it sees no breach of regulatory rules and norms by the Adani Group.

“I find that the allegations made against noticees in the SCN are not established. Considering the above, the question of devolvement of any liability on Noticees does not arise and hence the question of determination of quantum of penalty also does not require any deliberation,” said Kamlesh Chandra Varshneya in the SEBI order.

Earlier in 2023, Hindenburg had leveled allegations against Gautam Adani and his firm of stock manipulation, tax evasion by parking funds in tax havens, and inflated valuations. The report said Adani was able to add more than $100 billion in the past three years all because of the stock manipulations in the Adani Group’s seven key companies.