The ultra-low-cost carrier is in talks with vendors and aircraft lessors and is evaluating its fleet size to reduce its scale and gain operational efficiencies.

Spirit Aviation (FLYY) was on the retail traders’ radar on Wednesday after the low-cost airline reportedly revealed plans for further job cuts and a reduction in flight schedule in November to cut costs, weeks after declaring its second bankruptcy in less than a year.

According to a CNBC report, Spirit CEO Dave Davis wrote to employees in a memo that the company will see a 25% cut in capacity, compared to 2024, as it “optimizes” its network to focus on the “strongest markets.”

The report further stated the cuts were similar in scale to the ones made after Spirit emerged from its first bankruptcy in March through June. The ultra-low-cost carrier is also in talks with vendors and aircraft lessors and is evaluating its fleet size to reduce its scale and gain operational efficiencies.

“These evaluations will inevitably affect the size of our teams as we become a more efficient airline,” Davis reportedly said in the note. “Unfortunately, these are the tough calls we must make to emerge stronger. We know this adds uncertainty, and we are committed to keeping you informed as these decisions are made.”

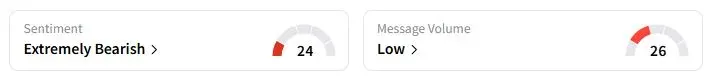

Retail sentiment on Stocktwits about Spirit was in the ‘extremely bearish’ territory at the time of writing. The stock has seen a 23% rise in follower count over the past 30 days.

Spirit, one of the most famous no-frills airlines, was largely successful before the onset of the pandemic. However, a shift in travelling patterns toward more expensive seats, higher costs, and aircraft issues has forced budget carriers to cede ground to larger players.

The airline had posted a loss of nearly $257 million since March 13, after it exited Chapter 11, through the end of June. Earlier this week, United Airlines CEO Scott Kirby confirmed that the airline is not looking to acquire Spirit’s assets.

Spirit’s rivals, including United, Frontier Airlines, and JetBlue, have already launched new flights on Spirit’s existing routes.

One Stocktwits user warned that the stock could hit 10 cents soon.

At the time of writing, Spirit stock closed at $0.35 in the OTC markets.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<