General Mills maintained its annual adjusted profit forecast, which is expected to decline 10% to 15%, while organic net sales are anticipated to be down 1% to up 1%.

General Mills (GIS) CEO Jeff Harmening stated that while addressing price is important, especially in this environment where consumers are seeking value, it’s not sufficient to generate long-term growth.

“In this environment where consumers are feeling the way they are, that’s (price) actually the more difficult piece rather than the volume piece. Volumes are pretty stable,” Harmening said on a post-earnings call.

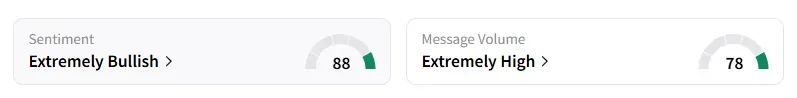

Retail sentiment on General Mills improved to ‘extremely bullish’ from ‘bullish’ territory compared to a day ago, with message volumes at ‘extremely high’ levels, according to data from Stocktwits.

Shares of the company were down nearly 1% during midday trading. General Mills maintained its annual adjusted profit forecast, which is expected to decline 10% to 15%, while organic net sales are anticipated to be down 1% to up 1%.

“As we look at our year, we need to be able to hold share in our categories to achieve the results we suggested for the year, but we don’t need to gain massive amounts of share to hit the guidance that we already said and get back to flat or a little bit of growth,” Harmening said. “It’s mostly up to our control. Consumers, their habits change over time. We’ve been really good at changing with them.”

A bullish user on Stocktwits predicts the stock will reach a minimum of $55 by next week.

General Mills’ first-quarter revenue of $4.52 billion came in line with Wall Street estimates. Its adjusted earnings per share of $0.86 topped expectations of $0.82, according to data from Fiscal AI.

Shares of General Mills have declined nearly 23% this year and lost 34% of its value in the last 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<