Citigroup maintained a ‘Buy’ rating and noted that Duolingo’s product announcements this year had a lower profile relative to the past.

Duolingo (DUOL) shares were down nearly 4% in early trading on Wednesday, becoming the top trending ticker on Stocktwits after Citigroup lowered its price target on the stock to $375 from $400.

Citigroup maintained a ‘Buy’ rating after attending the company’s annual global event Duocon 2025, according to TheFly. The firm believes that Duolingo’s product announcements this year had a lower profile compared to past years.

On Tuesday, Duolingo announced two major product updates at Duocon, primarily related to an integration that brings the Duolingo Score to LinkedIn Profiles, and the expansion of its Duolingo Chess course with an Android launch and a new player-versus-player mode on iOS.

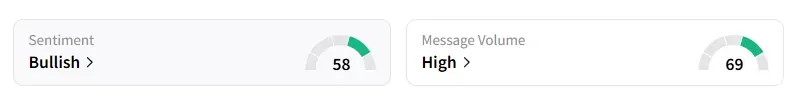

Retail sentiment on Duolingo improved to ‘bullish’ from ‘neutral’ territory a day ago, with message volumes at ‘high’ levels, according to data from Stocktwits.

A user on Stocktwits noted that they were considering accumulating Duolingo stock.

Citigroup stated that the company continues to enhance its platform, which should help drive engagement; however, the firm has reduced its Duolingo user forecasts to reflect trends in third-party apps.

In August, Duolingo beat its second-quarter results and raised its annual forecasts, driven by an increase in daily active users on the app.

Separately, media reports noted that Hungary’s competition authority was investigating Duolingo regarding misleading claims about the effectiveness of its platform.

Another user on Stocktwits noted that the stock was in a “great spot to buy.”

Shares of Duolingo have declined over 16% this year but have gained 8% in the last 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<