From 2014 till now, India has made a lot of progress during PM Modi’s tenure. India is now the fourth largest economy in the world. PM Modi and his economic policies have an important role in reaching here. Know about 11 such policy.

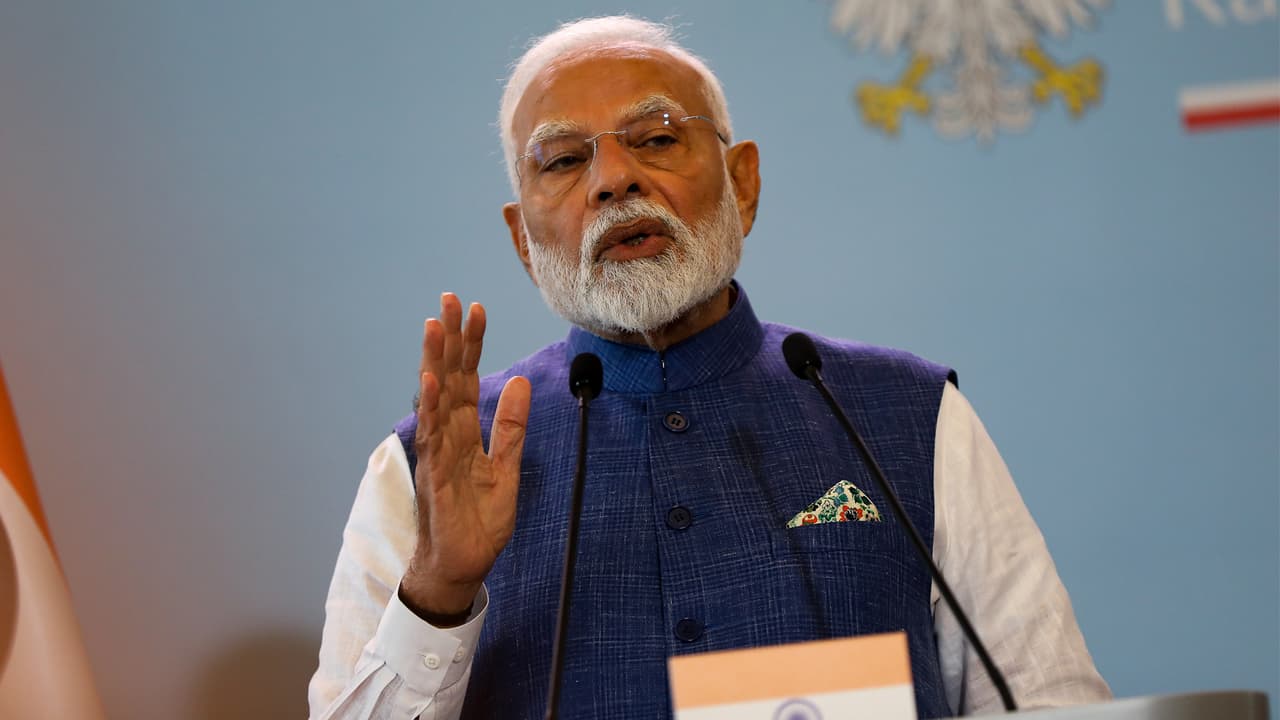

PM Modi Major Economic Decisions: Prime Minister Narendra Modi is celebrating his 75th birthday on 17 September. After becoming PM in 2014, many major economic decisions were taken under Modi’s leadership, which benefited at the local level, Globally also made a lot of progress. Even India’s name joined the top-5 largest economies in the world. Let’s know about the 11 biggest economic decisions of PM Modi.

1. GST

In 2017, GST imposed 17 types of taxes and 13 in the same tax. The number of active GST taxpayers increased from 60 lakhs to about 1.51 crore. A study by the Finance Ministry found that GST helped families to save at least 4% on total monthly expenses.

See also: PM Modi Birthday: Narendra Modi crossed these 7 milestones as Prime Minister

2. Financial Inclusion

Partners such as Jan Dhan Yojana and Mudra Yojana ensured financial inclusion for crores of Indians who were earlier deprived of banking services. Many accounts were brought under the purview of formal banking systems with more than 56 crore Jan Dhan accounts.

3. Digital India

Digital India changed the everyday life of people with governance by including technology in everything. More than 50% of the world’s real -time transactions are taking place through UPI in India. Direct Benefit transfer has saved more than Rs 4.31 lakh crore to the government by removing fake beneficiaries.

4. Make in India

Make in India and Productions incentive (PLI) scheme have jointly converted India from the import market to manufacturing and export global centers. India is now the world’s second largest mobile phone manufacturer country.

5. Ease of Doing Business Reforms

Since 2014, the government has reduced more than 42,000 compliance (compliance). At the same time, more than 3700 legal provisions have been non-reflected, which has removed the long-term obstacles to the enterprises. With quick approval of the National Single Windo Approval System, it has become very easy and fast to start and run business.

6. Insolvency and Bankruptcy Code

The insolvency and bankruptcy code has changed India’s insolvency structure by giving a clear, time bound mechanism to revive the trust of crisis, increase the confidence of creditors and attract investment. By March 2025, 1194 companies were resolved, in which the creditors recovered Rs 3.89 lakh crore, while the gross NPA came to a low of several decades of 2.3%, showing the health of the strong banking sector.

7. Reduction in income tax limit

Since 2014, the Modi government has continuously expanded income tax relief for individuals, which has reduced the burden on the middle class by increasing the exemption limit. In 2025, income up to 12 lakhs (Rs 12.75 lakh for salaried employees) has been completely taxed.

8. Bank Restructuring and Marsers

In 2019, 27 public sector banks merged with 12 strong institutions, causing affidavit and scale in the banking sector on a large scale. Gross NPA fell from 11.2% to 5% in 2024 in 2018, which led to a strong banking stability.

9. Control on inflation and fiscal discipline

Despite global shocks, inflation through fiscal and monetary policies of India decreased from 8.2% (2004-14) to about 5% (2015–25). GDP increased from Rs 106 lakh crore in 2014-15 to Rs 331 lakh crore in 2024-25.

10. Strong infrastructure for economic development

Since 2014, the Modi government has been focusing on developing a systematic, long -creature infrastructure plan to give impetus to economic growth. Rights such as National Infrastructure Pipeline, PM shift, dedicated freight corridor and widespread expansion of the National Highway have promoted trade and economic growth.

11. Corporate Tax Reforms

In 2019, the current government reduced corporate tax rates for domestic companies to 22% and 15% for new domestic companies. Also gave many other financial reliefs. These rates are now one of the most attractive rates in Asia, making India a strong option for global businesses.

Also read: PM Modi is the most popular leader in the world, where is US President Donald Trump in the list?