Overview

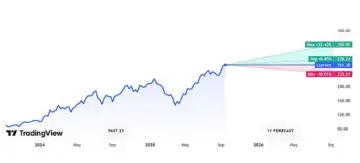

- TSMC Stock Price Prediction shows a one-year range from 235.21 (-10%) to 320.00 (+22%), with an average target of 278.24 (+6.45%).

- Strong AI and automotive chip demand could drive TSMC Stock higher, reinforcing its leadership in advanced semiconductors.

- Geopolitical risks and semiconductor cyclicality remain the biggest threats to Taiwan Semiconductor Manufacturing Company’s stock outlook.

Taiwan Semiconductor Manufacturing Company (TSMC) is the world’s largest dedicated semiconductor foundry and a key player in the global technology supply chain. Its advanced manufacturing capabilities power everything from smartphones and artificial intelligence chips to automotive processors and data centers. Thanks to its unique position in the semiconductor industry, the company’s performance has always attracted close attention from global investors. TSMC stock price prediction has become even more significant in recent years as chip demand fluctuates and geopolitical risks continue to rise.

The chart indicates that the TSMC stock price trades near 261.38, with a one-year forecast showing potential movement between 235.21 (-10.01%) and 320.00 (+22.43%), while the average expectation suggests 278.24 (+6.45%). These projections provide a wide range of outcomes, reflecting both the opportunities and risks ahead. Understanding where the stock could head in the next twelve months requires a closer look at its financial performance, industry dynamics, and external macroeconomic factors.

TSMC’s Current Position

TSMC stock has delivered strong returns over the past two years. The rally has been fueled by surging demand for advanced semiconductor technologies, particularly in high-performance computing, AI processors, and mobile applications. The company’s dominance in 3-nanometer and upcoming 2-nanometer chip production has positioned it as a leader far ahead of most competitors.

Revenue growth has been robust, but TSMC’s performance also depends heavily on cyclical demand patterns. When global consumer electronics or smartphone shipments weaken, quarterly results show pressure. However, the diversification into AI and automotive chips has provided a strong buffer, reducing reliance on traditional segments.

TSMC stock price suggests that investor sentiment is cautiously optimistic. While growth opportunities are significant, there is also awareness of risks tied to supply chain issues, competition, and geopolitical uncertainty.

Growth Drivers for the Next Year

Artificial Intelligence and Data Centers

One of the strongest catalysts for TSMC stock price prediction is the rise of AI and accelerated computing. Companies like Nvidia, AMD, and Apple rely on TSMC’s advanced nodes for manufacturing high-performance chips. The ongoing AI boom is expected to continue through 2025 and beyond, with chip demand for data centers expanding rapidly.

TSMC’s ability to secure long-term contracts with these companies ensures steady revenue visibility. If demand continues at the current pace, stock performance could trend toward the higher range of projections, closer to 320.00 (+22.43%).

Automotive and Internet of Things

Another important driver is the automotive industry’s growing reliance on semiconductors. Electric vehicles (EVs) and autonomous driving technologies require increasingly complex chips. TSMC has invested in expanding its automotive product lines, which could provide stable revenue growth in the medium term. The Internet of Things (IoT) market also contributes to diversification, spreading revenue streams across industries.

Technology Leadership

TSMC’s leadership in manufacturing technology is unmatched. The transition to 2-nanometer production in the next couple of years will further strengthen its dominance. While competitors like Intel and Samsung are trying to catch up, TSMC remains ahead in both scale and reliability. This leadership supports premium pricing power, a critical factor that influences TSMC stock price stability and long-term growth potential.

Risks and Challenges

Geopolitical Uncertainty

One of the biggest concerns surrounding TSMC stock prediction is geopolitical risk. Tensions between the United States and China over Taiwan remain a major overhang. Investors remain sensitive to any developments that could threaten supply chain stability. Although TSMC has been diversifying manufacturing bases with plants in the United States and Japan, Taiwan still houses the majority of its advanced facilities.

Semiconductor Cyclicality

The semiconductor industry is inherently cyclical. Periods of high demand are often followed by slowdowns, as seen in the past with memory chips and consumer electronics. If global economic conditions weaken in 2025, demand for consumer products such as smartphones could decline, potentially pushing the TSMC stock price closer to the lower end of forecasts at 235.21 (-10.01%).

Competitive Pressures

Although TSMC enjoys a clear lead, competition is intensifying. Samsung continues to push its foundry services, and Intel has made aggressive investments in regaining manufacturing leadership. While TSMC’s scale remains an advantage, any technological delays could shift market share.

Financial Outlook

Financial Outlook

TSMC financial performance continues to remain strong, supported by high margins and steady capital expenditure on new technology. The company has consistently maintained profitability, with operating margins among the highest in the semiconductor industry. Cash flows remain robust, allowing for reinvestment in new fabs and potential shareholder returns.

The one-year forecast suggests average growth potential of 6.45%, which aligns with modest expectations for the sector. However, given the rising demand for AI and advanced chips, actual performance could exceed this average if growth momentum continues.

Market Sentiment and Analyst Views

Analyst sentiment toward TSMC stock is largely positive. Many investment banks highlight the company as one of the safest long-term bets in the semiconductor sector. The primary reason is the tech giant’s near-monopoly on leading-edge technology, which remains difficult to replicate.

However, caution is advised due to external risks. Most forecasts place the stock within a moderate growth range, acknowledging both upside from technology leadership and downside from cyclical slowdowns. This balanced outlook explains the forecast spread between 235.21 and 320.00.

Technical Indicators

From a technical perspective, the TSMC stock price has been in an upward trend over the past two years, showing strong resilience despite periodic corrections. The current level of 261.38 positions the stock near its recent highs, with momentum indicators suggesting further room for growth if demand stays strong.

Support levels are seen near 240, aligning with the minimum forecast. Resistance levels are around 280-300, consistent with the average and maximum projections. Investors tracking technical patterns may see consolidation in the short term before another upward move.

Forecast for the Next 12 Months

Based on available data, the TSMC stock price prediction for the next year falls into three potential scenarios:

Bullish case: If AI demand accelerates, global markets stabilize, and geopolitical tensions remain contained, the stock could move toward 320.00 (+22.43%).

Base case: With steady growth and moderate demand, the average forecast of 278.24 (+6.45%) seems reasonable.

Bearish case: In case of global slowdown, demand correction, or geopolitical shock, the stock could slip toward 235.21 (-10.01%).

Final Thoughts

TSMC remains the backbone of the global semiconductor ecosystem. The company’s dominance in advanced chip manufacturing, leadership in technology, and strong customer base make it one of the most valuable players in the market. The one-year TSMC stock price prediction reflects a broad range of possible outcomes, from modest declines to strong gains.

The most likely scenario suggests moderate upside toward 278.24, driven by AI and automotive growth, while the bullish case could see prices reach 320.00. On the other hand, risks tied to economic cycles and geopolitical uncertainty could weigh on performance, pushing the stock closer to the 235.21 level.

For investors following semiconductor trends, TSMC remains a critical company to watch. Its performance over the next year will not only shape its own stock trajectory but also influence broader market sentiment in the technology sector.