Lawmakers are set to meet with 18 industry leaders, including Strategy’s Executive Chairman Michael Saylor, Executive Chairman of Bitmine Immersion Tom Lee, and others, to discuss President Donald Trump’s proposed Strategic Bitcoin Reserve later on Tuesday.

Crypto markets traded cautiously in early morning trade on Tuesday, with Bitcoin (BTC) and Ethereum (ETH) drifting as the Federal Reserve was on track to begin a two-day meeting expected to shape the path for the first interest-rate cut of 2025.

Fed Chair Jerome Powell’s news conference on Wednesday, following the Federal Open Market Committee (FOMC) ‘s meeting, is likely to signal how quickly the central bank could move on rate cuts. Bitcoin (BTC) has inched higher after weeks of sideways trading, but remains nearly 3% below its late-August high of more than $118,000 and 7% below its previous record of $124,000. At the time of writing, Bitcoin’s price had gained 0.5% in the last 24 hours, with retail sentiment on Stocktwits trending in ‘bearish’ territory over the past day.

Ethereum (ETH), meanwhile, has pulled back after setting a fresh record of more than $4,900 last month, with traders eyeing $5,000 if policy signals turn dovish. Ethereum’s price fell 0.3% in the last 24 hours, trading at around $4,500 at the time of writing. Retail sentiment around the second-largest cryptocurrency by market capitalization also remained in ‘bearish’ territory over the past day.

Other major altcoins showed cautious optimism, with Solana (SOL) edging 0.1% lower and meme token Dogecoin (DOGE) edging 0.3% higher. Cardano (ADA) and Ripple’s native token (XRP) had higher gains. Cardano’s price rose 1.2% in the last 24 hours, while XRP’s price climbed 1.8%.

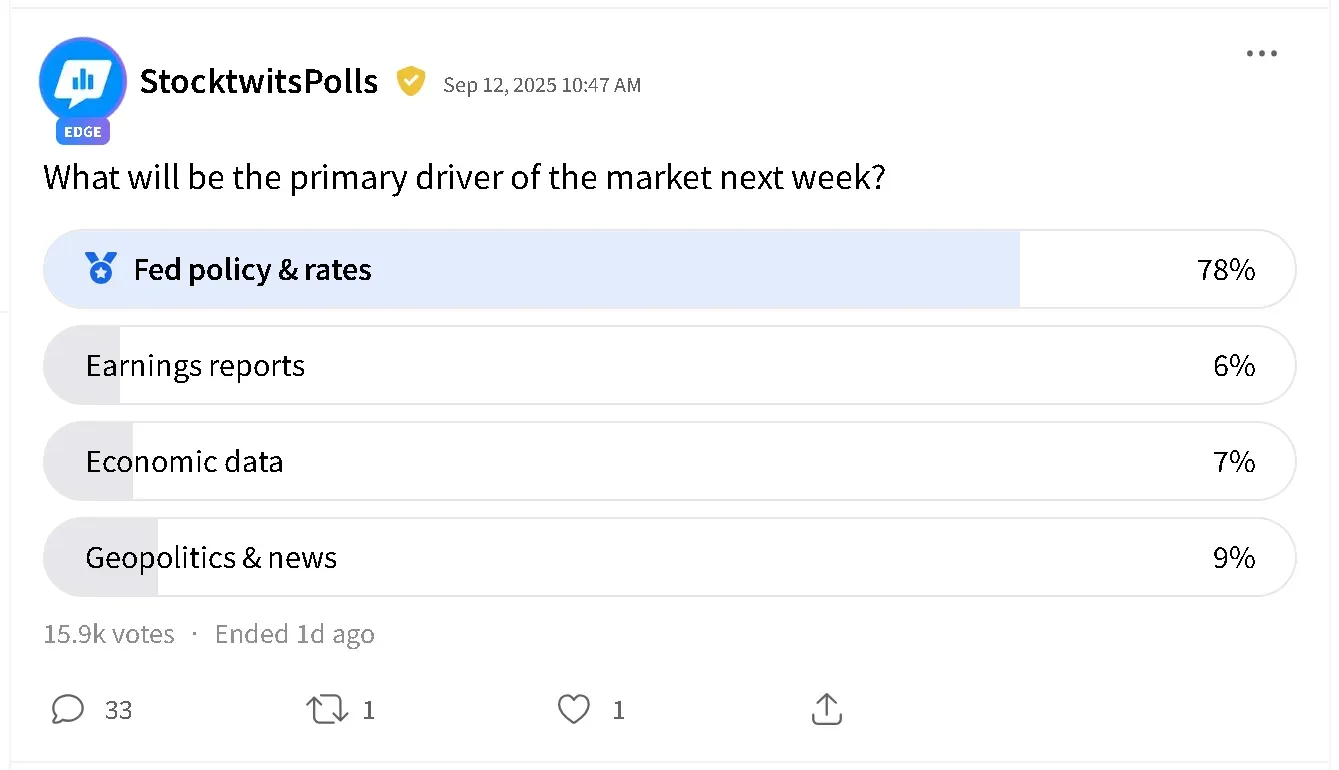

According to a poll on Stocktwits, retail traders overwhelmingly said that the Federal Reserve’s policy and interest rate decisions would be the primary driver of the market this week.

At the same time, lawmakers are set to meet with 18 industry leaders, including Strategy’s (MSTR) Executive Chairman Michael Saylor, Executive Chairman of Bitmine Immersion (BMNR), and Fundstrat’s Tom Lee, and Marathon Digital (MARA) CEO Fred Thiel, to discuss President Donald Trump’s proposed Strategic Bitcoin Reserve, later on Tuesday.

Advocacy group The Digital Chambers told Coin Telegraph that the meeting will center on the BITCOIN Act, which calls for the U.S. government to acquire 1 million Bitcoin (BTC) over five years using budget-neutral financing through the Fed and Treasury. The initiative comes as Congress weighs broader digital asset legislation, following the passage of the GENIUS Act stablecoin bill in July.

The overall cryptocurrency market gained 0.4% over the last 24 hours, trading at a market capitalization of over $4.1 trillion. Crypto futures bets saw around $194 million in liquidations over the past 24 hours, according to Coinglass data. Long liquidations totaled around $141 million, and short bets amounted to $52 million.

Digital asset treasury (DAT) equities edged higher in pre-market trade. MSTR’s stock gained around 0.34% and BMNR’s stock rose around 0.6%. Crypto exchange Coinbase (COIN) edged 0.14% higher. Bitcoin miners like Marathon Holdings (MARA) and Riot Platforms (RIOT) showed mixed movement. MARA’s stock fell 0.31%, while RIOT’s stock gained 0.48%.

Read also: Bloom Energy Stock Jumped 7% This Morning – Here’s What Happened

For updates and corrections, email newsroom[at]stocktwits[dot]com.<