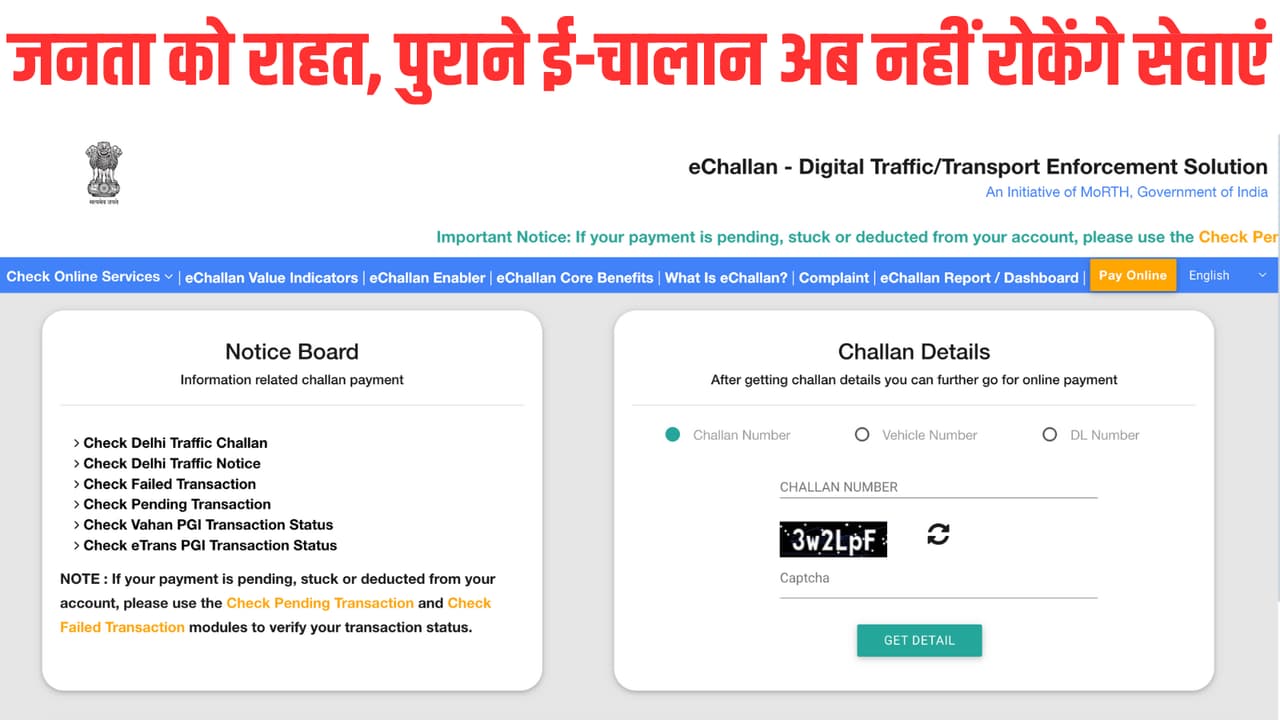

UP E-Challan Settlement: Uttar Pradesh Transport Department announced to abolish non-tax e-challans of 2017–2021. Court-pending and office-pending invoices will be closed. This will automatically remove obstacles like fitness, permit, HSRP.

The Uttar Pradesh Transport Department has taken a big relief to the public. It has been decided to abolish millions of non-tax e-operations built from 2017 to 2021. Now vehicle owners will get rid of obstacles in services like fitness, permit, vehicle transfer and HSRP.

Non-tax e-challan from 2017 to 2021 will end

The department has clarified that the challans whose deadline has been completed will be shown in two categories on the portal:

- Disposed – Abated: If the case was pending in court.

- Closed-Time-Bar (Non-tax): If the office was pending and the time has passed.

Tax -related invoices will be outside the purview of this scheme.

Also read: Roads of Lucknow will be pitched before Deepawali, Municipal Corporation approved a budget of 400 crores

Process will be completed in 30 days, update will be seen on portal

The Transport Department has said that this entire process will be completed within 30 days. After this, the vehicle owners will be able to visit the portal and see the status of their challan. Neither no one will get refunds nor old challans will be reopened.

More than 30 lakh invoices will affect

- Between 2017 and 2021, 30.52 lakh e-challan were created.

- Of these, 17.59 lakhs have already been disposed of.

- Now the remaining 12.93 lakh challans (10.84 lakh in court and 1.29 lakh office level) will be dealt with digital manner.

All the barriers at the front-end will be removed while the entire record at the back-end will be safe.

What do the public have to do?

- After a month, check the situation by visiting the e-challan/transport portal.

- Disposed on pending cases in court – Abated written.

- Closed on pending cases at office level will be recorded-Time-Bar (Non-tax) will be recorded.

- Tax related challans will remain separate and will be dealt with only under the tax law.

- Contact the helpline 149 or nearest RTO/Arto on any problem.

Why was this decision taken?

This decision will apply only to cases which were pending till 31 December 2021. Cases related to tax, serious crime, accident or IPC will be outside the purview of this relief. The department believes that this step was necessary to relieve the public from unnecessary problems and make services transparent.

30 days time limit and strict monitoring

The NIC is making changes in the portal so that the entire process remains transparent and safe. The progress report will be shared on a dashboard every week. Tax related liabilities and court orders will remain unchanged.

Transport Commissioner’s statement

Transport Commissioner Brajesh Narayan Singh said: “This decision shows the commitment of the law right, the public and transparent administration. Our goal is to provide accessible and respectable services to the citizens on time. All officers and employees should ensure 100 percent compliance in the scheduled time-limit.”

Also read: Sant Kabir Textile Park to be built in Uttar Pradesh, millions of youth will get employment