Morgan Stanley expects only minor adjustments in the Summary of Economic Projections, and a similar tone from Chair Powell as in his Jackson Hole speech.

The Federal Reserve, led by Jerome Powell, is set to kick off a two-day monetary policy meeting on Tuesday to deliberate on the Fed funds rate. Most market participants, economists, and strategists have baked in a 25-basis-point cut to the Fed’s policy rate, which is the rate at which banks lend reserve balances to each other overnight.

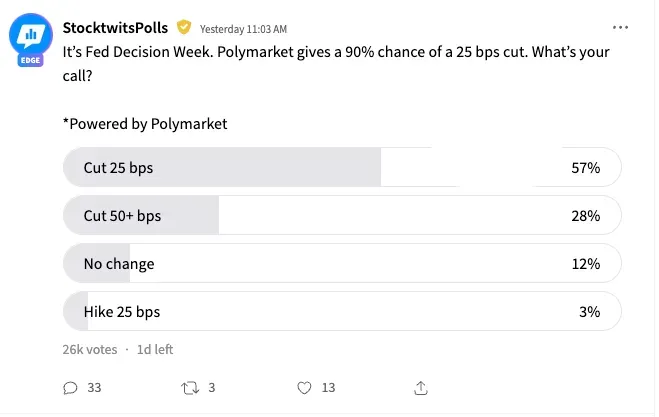

An ongoing Stocktwits poll that asked users of the platform regarding their expectations found that retail traders were also aligned with the experts. About 25,700 users have now answered the question, “It’s Fed Decision Week. Polymarket gives a 90% chance of a 25 bps cut. What’s your call?”

Polymarket is Stocktwits’ official predictions market partner. The Stocktwits poll found that 57% of the respondents braced for a 25 basis-point cut, and a sizeable proportion (29%) expected a bigger 50 basis-point reduction. While 11% expected no change, a modest 3% saw the central bank raising rates by 25 basis points from the prevailing 4.25% to 4.50% rate.

While Polymarket odds put the chances of a quarter-point cut at 91%, the CME FedWatch Tool, constructed based on futures traders’ expectations, forecasts 96% probability of a cut of similar magnitude.

Hopes for a rate cut have fueled a strong rally in the markets, which are now trading at record levels. The SPDR S&P 500 ETF (SPY), an exchange-traded fund (ETF) that tracks the S&P 500 Index, and the Invesco QQQ Trust (QQQ) jumped 13.44% and 16.04%, respectively, for the year.

Sentiment toward the SPY and QQQ ETFs was ‘bullish’ by early Tuesday, while the message volume stayed at ‘normal’ levels.

Commenting on the poll, one Stocktwits user said there is no way the “conservative” Powell cuts rates by more than 25 basis points. “He wouldn’t even be doing that if it weren’t for such outsized pressure on him and the Fed in general over the last 6 months,” they said.

Another user said they expected a 25 basis-point cut and the signal that more cuts could be on the way, and the quantitative tightening would end.

A user who predicted no change said this would be a dampener, pushing stocks down by 5-10% on Wednesday, allowing financial institutions to buy them at a discount.

In a note previewing the September Federal Open Market Committee (FOMC) meeting, Morgan Stanley Chief U.S. Economist Michael Gapen said the firm expects a 25 basis-point cut without any change to balance sheet policies. It expects a dissent from Stephen Miran, who is the newest governor of the Federal Reserve Board following his Senate confirmation late Monday. The former White House economist is likely to support a steeper 50-basis-point cut.

“We expect only minor adjustments in the SEP and a similar tone from Chair Powell as in his Jackson Hole speech: risks to both sides of the dual mandate justify adjustments to policy, but the pace should be data dependent,” Gapen said.

“We now project four consecutive 25bp rate cuts in September, October, December, and January, bringing the target range to approximately 3.375% – the upper bound of most Fed estimates of neutral based on the long-run dots.”

For updates and corrections, email newsroom[at]stocktwits[dot]com.<