This is Suzlon’s second-largest order to date and comes amid Tata Power’s push for 100% clean energy by 2045.

Suzlon Energy and Tata Power shares gained 2% on Tuesday after signing a multi-state wind power project. Suzlon bagged a 838 MW wind power project from Tata Power Renewable Energy, its second-largest so far.

This project will use Suzlon’s wind turbines and reinforce their partnership with Tata Power as they work towards a clean energy transition in India.

Suzlon Energy and Tata Power were among the top-five trending stocks on Stocktwits at the time of writing.

Mega Wind Power Project

In a press release dated September 16, Suzlon announced its largest order in FY26, an 838 MW project with Tata Power Renewable Energy. This marks Suzlon’s second-largest order to date, following the 1,544 MW order from NTPC Green Energy.

The project will deploy 266 units of Suzlon’s advanced S144 wind turbines, each with a capacity of 3.15 MW. Spread across Karnataka (302 MW), Maharashtra (271 MW), and Tamil Nadu (265 MW), the installations will provide grid-stable, round-the-clock renewable energy.

“As Tata Power Renewable Energy embarks on a strategic transformation to achieve 100% clean power by 2045, we’re proud to support this ambitious journey with our advanced, ‘Made in India’ wind technology,” said Girish Tanti, vice chairman of Suzlon Group.

Suzlon: Analyst Take

Suzlon’s 838 MW order from Tata Power Renewable Energy is a positive development, showcasing both scale and operational reach across three states. The deal enhances Suzlon’s revenue visibility for FY26 and could improve capacity utilization and margins, provided execution remains smooth, said SEBI-registered investment advisor Nidhi Saxena.

The “Made in India” positioning and its role in a Firm and Dispatchable Renewable Energy (FDRE) project highlight strong policy tailwinds, with FDRE gaining importance as India prioritizes grid stability and round-the-clock clean power, she added.

However, risks remain around execution delays, cost overruns, supply chain challenges, and the sector being cyclical, the analyst stated.

At the current market price of ₹59 for Suzlon, there appears to be room for upside toward the ₹75 – ₹90 range over the next 6–12 months, assuming favorable conditions, she said.

What Is The Retail Mood?

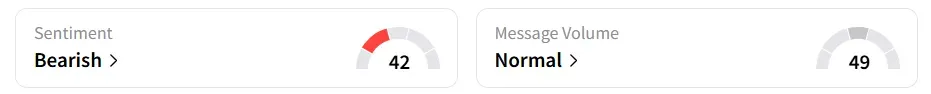

Despite the project win, retail sentiment for Suzlon on the platform was ‘bearish’. Despite being ‘bullish’ a week ago, sentiment has largely been bearish over the past year. During that time, the stock has declined more than 28%. Year-to-date, the losses stand at 5%.

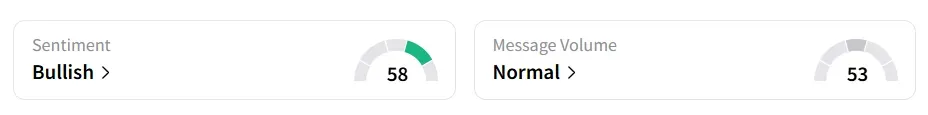

Retail sentiment for Tata Power remains ‘bullish’. It was ‘neutral’ a month back, during which it gained over 3%.

Year-to-date, the stock has edged up 0.9%.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<