Despite some trading apps showing a steep fall, the price decline was technical, reflecting bonus share adjustments.

Shares of Godfrey Phillips surged nearly 9% on Tuesday after the company turned ex-bonus. The tobacco manufacturer’s board had approved a 2:1 bonus issue on August 4, which means shareholders will receive two additional shares for every one share held as of the record date.

The record date to determine eligibility was fixed at September 16. This is the first bonus issue for Godfrey Phillips shareholders.

Why The Price Looked Like It Crashed

On Monday, the stock closed at ₹10,211 (pre-adjustment) but opened at ₹3,681 on Tuesday after adjustment. While some trading apps initially showed a steep fall of up to 66% in the stock price, the decline was due to the bonus adjustment.

The company used ₹2,079.76 lakh from its general reserves and/or retained earnings for this bonus issuance. Post the corporate action, Godfrey’s market capitalization stood at around ₹57,296 crore.

Bonus Shares Explained

Bonus shares are issued at no cost to investors, drawn from a company’s reserves. While they increase the number of shares in circulation and lower earnings per share, they do not dilute equity.

Shareholders who owned the stock before the record date are eligible for the bonus allotment, while investors buying on or after the record date will not qualify.

Godfrey joins the list of prominent companies such as HDFC Bank, Nestle India, Bajaj Finance, and Patanjali Foods that have announced bonus issues this year.

Stock Watch

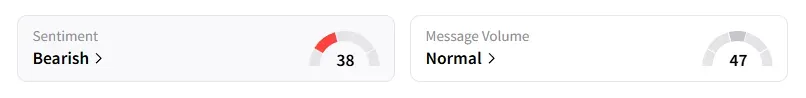

At the time of writing, the shares were trading at ₹3,681 each. Retail sentiment on Stocktwits has been ‘bearish’ for a week.

The stock has surged 111% year-to-date (YTD).

For updates and corrections, email newsroom[at]stocktwits[dot]com.<