Tesla is experiencing a flow of positive data points, which will likely support the stock’s recent strength, the analyst told investors in a research note.

Barclays expects Tesla’s (TSLA) third-quarter deliveries to be above the consensus estimate, though flat year-over-year. The analyst anticipates Tesla deliveries in the three months through the end of September to be around 465,000 units, above the consensus estimate of about 430,000 units.

Notably, in the third quarter of 2024, Tesla reported 462,890 vehicle deliveries. Tesla is experiencing a flow of positive data points, which will likely support the stock’s recent strength, the analyst told investors in a research note, as per TheFly. The firm sees potential for the share strength to continue with a Q3 deliveries beat.

However, Barclays believes investors may also consider Tesla’s weaker expected volume outlook for Q4 and beyond, especially in the U.S., where the firm predicts a significant decline in electric vehicle demand after the expiration of the EV tax credit on September 30.

Barclays keeps an ‘Equal Weight’ rating on Tesla with a $275 price target.

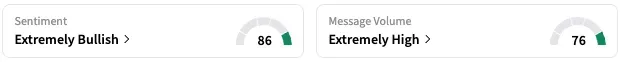

On Stocktwits, retail sentiment around TSLA stock jumped from ‘bullish’ to ‘extremely bullish’ territory over the past 24 hours, while message volume rose from ‘high’ to ‘extremely high’ levels.

Separately, Tesla CEO Elon Musk acquired 2.57 million Tesla shares in multiple tranches on Friday, with the acquisition price ranging between $371 and $396.

A Stocktwits user opined that Musk’s purchase of nearly $1 billion worth of Tesla shares was “down payment to get shareholders to approve his new pay package.” The Tesla board proposed a $1 trillion pay package for Musk over the next decade earlier this month. The proposed package will be put to shareholder approval in November.

Another user highlighted Tesla’s strong rally despite the pessimism.

TSLA stock is up 1% this year and approximately 81% over the past 12 months.

Read also: Why Did NanoVibronix Stock Jump A Whopping 74% Today?

For updates and corrections, email newsroom[at]stocktwits[dot]com.<