The apex cryptocurrency gained 0.4% to $116,514 over the past 24 hours, while Ethereum slipped 0.6% to $4,661.57, and XRP fell 0.6% to $3.06, at the time of writing.

Bitcoin was up in the early hours on Monday, but XRP and Ethereum edged lower, ahead of a much-anticipated Federal Reserve meeting in which the central bank is widely expected to reduce its benchmark interest rates.

The apex cryptocurrency gained 0.4% to $116,514 over the past 24 hours, while Ethereum slipped 0.6% to $4,661.57, and XRP fell 0.6% to $3.06, at the time of writing, according to CoinGecko data. Among other tokens, Dogecoin was down 4.4% to $0.28, following a rally last week.

According to data from SoSoValue, Bitcoin spot ETFs logged their best week since July after raking in $2.34 billion in the week ended on Sept. 12. On Friday, BlackRock’s IBIT ETF attracted $264.7 million while Fidelity’s FBTC ETF saw inflows of $315.2 million.

After a tepid start to the month, digital tokens have found a firmer footing as a growing number of companies are adding cryptocurrencies to their balance sheets. This increased buying activity comes ahead of a likely rate cut in the U.S. central bank’s policy-setting meeting on Sept. 16-17.

According to the CME Group’s FedWatch tool, over 96% traders have priced in a 25-basis-point cut. Some analysts have predicted two more cuts of similar levels this year.

“A cooling economy and weakening jobs market will help to dampen inflation tied to tariffs, and the Fed is now in a position to resume loosening policy from ‘somewhat restrictive’ territory towards a neutral footing,” ING Commodities analysts said.

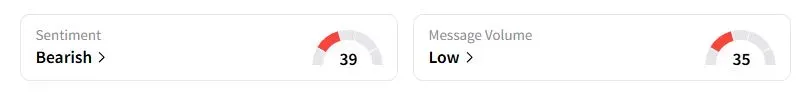

Retail Sentiment on Stocktwits about Bitcoin was still in the ‘bearish’ territory at the time of writing.

“I think that we’ll see some consolidation, the $117K level is an important resistance zone and basically the final one until we’re seeing a new all-time high (ATH),” said Michael Van De Poppe, about Bitcoin’s near-term price movement.

Ethereum to enter a bull market?

In a podcast aired on Sunday, investor Tom Lee said Ethereum is at an advantageous position compared to peers with the passage of the GENIUS Act, which will provide regulatory support for stablecoins.

“Ethereum is facing a moment that what we call a supercycle, similar to what happened in 1971 when the U.S. dollar went off the gold standard,” Lee said.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<