The stock was among the top five trending tickers at the time of writing, with over 260,000 shares already changing hands.

Asset Entities Inc. (ASST) shares surged 16% in premarket trading on Friday as traders anticipated the expected closing of its takeover by Strive Enterprises.

The stock was among the top five trending tickers at the time of writing, with over 260,000 shares already changing hands. The combined entity will focus on setting up a Bitcoin treasury after the close, when it will be renamed Strive Inc. and will be led by Strive Enterprises’ CEO, Matt Cole.

The merger comes amid renewed interest among companies in creating cryptocurrency treasuries, following the footsteps of Michael Saylor’s Strategy, which holds over 630,000 Bitcoins, currently valued at over $73 billion.

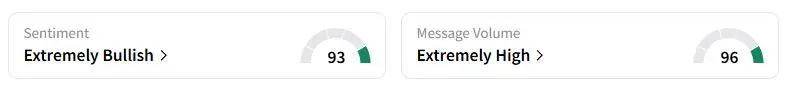

Retail sentiment on Stocktwits about Asset Entities was in the ‘extremely bullish’ territory at the time of writing.

The deal was first announced in May, with the companies offering a unique share-to-Bitcoin exchange in a manner that is intended to be tax-free to investors under section 351 of the U.S. tax code.

Concurrent to the closing of the deal, the firm expects to raise more than $750 million through a private placement financing (PIPE), with an additional $750 million potentially available upon the exercise of warrants.

Asset Entities provides social media marketing, management, and content delivery across Discord, TikTok, Instagram, X, and other social media platforms.

Strive was founded by Cole and former presidential candidate Vivek Ramaswamy, who is currently running to become the Ohio Governor. Strive Asset Management, a unit of the company, now manages over $2 billion in assets.

“Hope they drop the news pre-market so we can run all day,” one user said.

Asset Entities’ stock has surged nearly 1,700% this year.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<