A close above ₹280 could revive buying interest, says the analyst

Petronet LNG shares are in a consolidation mode after a sharp decline in August. SEBI-registered analyst Deepak Pal noted that while its technical charts flag caution, its stable fundamentals, long-term contracts, and upcoming Q2 earnings could provide the next trigger for India’s leading LNG importer.

Technical Outlook

The stock is trading below its 50, 100, and 200-day Exponential Moving Averages (EMAs), which signals a bearish to neutral structure.

Its Relative Strength Index (RSI) is at 46, indicating neither oversold nor an overbought condition, showing sideways momentum. MACD is still in the negative zone but flattening out, suggesting that bearish momentum is weakening.

Parabolic SAR dots are above the price, showing resistance pressure, but any close above ₹280 may trigger fresh buying interest. Immediate support is placed around ₹270, while resistance is seen at ₹285–290.

Fundamental View

The company has strong cash flows, stable margins, and long-term contracts ensuring revenue visibility. However, volatility in global LNG prices and government policy on gas usage/subsidies can impact profitability in the short run, according to Pal.

Growth Triggers

Expansion plans in LNG terminals may drive future growth. Additionally, the government’s push for a “gas-based economy” supports the long-term outlook. Watch out for Q2 earnings expected in October. Pal added that better-than-expected volumes may lead toa stock re-rating.

Key Levels To Watch

He identified support at ₹270 and resistance near ₹285–290. A sustained move above ₹290 can open the path towards ₹305, while a breakdown below ₹270 may drag it towards ₹260, Pal concluded.

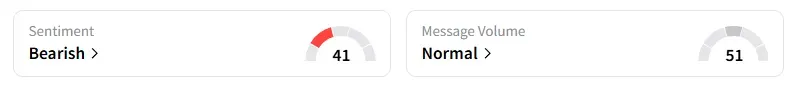

What Is The Retail Mood?

Data on Stocktwits shows that retail sentiment turned ‘bearish’ a day ago on this counter.

Petronet LNG shares have declined 18% year-to-date (YTD).

For updates and corrections, email newsroom[at]stocktwits[dot]com.<