Board approved a record ₹18,000 crore share buyback at ₹1,800 per share, offering a 19.2% premium to Thursday’s close. The IT major also inked a decade-long partnership with HanesBrands.

Infosys shares rose 1.8% to ₹1,536.80 in early trade on Friday, as investors cheered the company’s largest-ever buyback program.

Infosys’ board of directors approved a share buyback worth ₹18,000 crore, the largest ever by the IT bellwether. The company will repurchase 10 crore fully paid-up equity shares of face value ₹5 each at ₹1,800 per share in cash.

This represents a 19.2% premium over Thursday’s close of ₹1,509.7.

The share buyback does not exceed 25% of the total paid-up capital and accounts for 2.41% of the company’s share capital, Infosys said in a statement on Thursday.

Infosys ended FY25 with cash and equivalents of over ₹42,000 crore and free cash flow of more than ₹20,000 crore. The buyback will be funded from free reserves, consistent with its policy of returning 85% of free cash flow over five years via dividends and share repurchases.

The IT giant approved the buyback via the tender offer method. In a tender offer, the company proposes to repurchase shares from existing shareholders at a fixed price, typically set at a premium over the market rate. Shareholders then have the option to tender their shares within a defined window.

The company first announced the buyback proposal on September 8. And since then, the stock has rallied 7.4%.

Analyst Take

SEBI-registered analyst Saurabh Sahu said that this buyback move reflected Infosys’ confidence in its long-term growth and commitment to delivering value to shareholders, adding that global investors, including ADS holders, are expected to participate in this initiative after obtaining regulatory approvals.

Previous Buybacks

This buyback is almost twice the ₹9,300 crore program in October 2022, when shares were repurchased through the open market at a maximum price of ₹1,850. Infosys had conducted a ₹8,260 crore buyback in 2019 and a ₹13,000 crore program in 2017.

Brokerage View

Morgan Stanley maintained a ‘buy’ rating on Infosys, with a target price of ₹1,880. The brokerage sees 3.6% revenue growth in FY26 on a dollar basis. The stock is valued at 20x its expected FY27 earnings with a yield of 4.4%.

Partnership With HanesBrands

Separately, Infosys tied up with NYSE-listed global apparel company HanesBrands, under which Infosys will manage HanesBrands’ digital business applications and data landscape for ten years.

Stock Watch

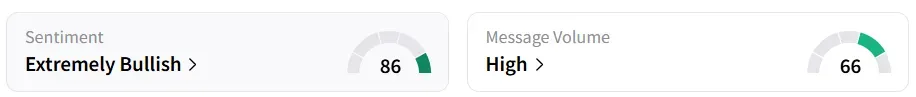

Retail sentiment for Infosys shifted to ‘extremely bullish’ on Stocktwits, having been ‘bearish’ last week. Market chatter has been ‘high’ over the last couple of sessions. It was among the top 10 trending stocks on the platform.\

Year-to-date, the stock has shed over 18%.

For updates and corrections, email newsroom[at]stocktwits[dot]com. <