Avidity said on Thursday that it intends to offer and sell $500 million of shares of its common stock in an underwritten public offering.

Shares of Avidity Biosciences, Inc. (RNA) fell 20% in the pre-market session on Thursday after the company announced that it intends to offer and sell $500 million of shares of its common stock in an underwritten public offering.

The company stated that it intends to grant the underwriters an option to purchase up to an additional $75 million of shares, while adding that there can be no assurance as to whether or when the offering may be completed.

The proceeds of the offering are expected to advance the development of the company’s three late-stage clinical programs, help build appropriate commercial inventory levels to support multiple potential launches, and expand its commercial infrastructure. The company also intends to progress research and development associated with its Antibody Oligonucleotide Conjugates platform and use the proceeds for working capital and general corporate purposes.

Avidity had cash, cash equivalents, and marketable securities totaling approximately $1.2 billion as of June 30. It had stated in August that it expects to have sufficient funds for its operations through mid-2027.

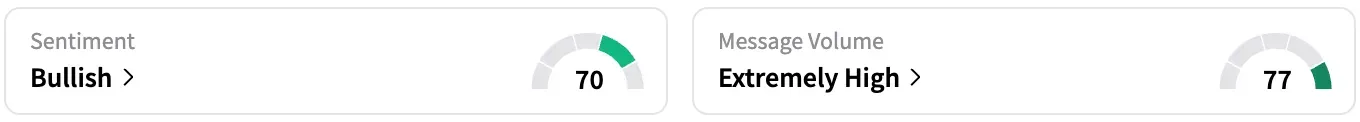

On Stocktwits, retail sentiment around RNA stock rose from ‘neutral’ to ‘bullish’ over the past 24 hours, while message volume rose from ‘normal’ to ‘extremely high’ levels.

A Stocktwits user opined that Avidity stock has a good chance of hitting $100 in a year.

The Financial Times reported last month that Novartis made a takeover approach for Avidity, adding that the discussions were at an early stage and might not result in a deal.

Avidity has three programs under development for three distinct rare diseases affecting the muscles: myotonic dystrophy type 1 (DM1), facioscapulohumeral muscular dystrophy (FSHD), and Duchenne Muscular Dystrophy (DMD). Bank of America raised its price target on Avidity to $56 from $54 on Thursday, while maintaining a ‘Buy’ rating on the shares. The firm pinned the price target hike on recent study results, which showed that treatment with Avidity’s Del-zota reversed disease progression in patients with DMD.

RNA stock is up by about 60% this year and by about 14% over the past 12 months.

Read also: Dow Futures Edge Higher As Wall Street Awaits Consumer Inflation Data: ORCL, OPEN, KLAR, ADBE Among Stocks To Watch

For updates and corrections, email newsroom[at]stocktwits[dot]com.<