Citi said it anticipates quarterly results in line with expectations but projects a stronger-than-expected outlook for the future.

Micron Technology Inc. (MU) stock gained attention on Thursday, drawing significant investor interest after the shares rose over 8% in morning trade.

The memory and storage solutions provider received a bullish nod from Citi, which lifted its price target on the stock to $175 from $150 while reiterating a ‘Buy’ rating, according to TheFly.

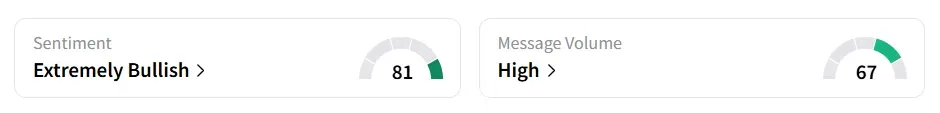

The revised forecast comes just ahead of Micron’s upcoming fourth-quarter (Q4) earnings release, scheduled for September 23. On Stocktwits, retail sentiment around Micron stock remained in ‘extremely bullish’ territory amid ‘high’ message volume levels.

A bullish Stocktwits user said raising the price target before the earnings shows confidence in the company’s business.

Another user was pleasantly surprised by the stock movement.

While Citi anticipates quarterly results in line with expectations, the firm projects a stronger-than-expected forward outlook, largely due to rising prices in both DRAM and NAND segments. The firm’s updated earnings forecast for fiscal 2026 now stands 26% higher than the current market consensus.

The optimistic forecast underscores growing confidence in the recovery of the memory semiconductor cycle, driven by AI infrastructure investments and increased demand for advanced computing capabilities.

For Q4, the company anticipates revenue of $10.7 billion ± $300 million and an adjusted earnings per share (EPS) of $2.50 ± $0.15, compared to an estimate of $11.08 billion and $2.85, respectively, according to Fiscal AI data.

Micron Technology stock has gained over 79% year-to-date and over 66% in the last 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<