As Bitcoin hit a record-low volatility, Stake ‘n Shake increased its national Bitcoin exposure by $10 million.

- Steak ’n Shake said it boosted Bitcoin exposure by $10 million and claimed same-store sales have risen “dramatically” since it began taking Bitcoin.

- The food chain reiterated that all Bitcoin payments go into its Strategic Bitcoin Reserve, after launching the reserve in late October.

- The fast food chain will deposit all Bitcoin payments into the SBR and said that for every Bitcoin meal sold over a year, 210 satoshi will be donated.

Steak ‘n Shake stated on Saturday that it increased its Bitcoin (BTC) exposure and reiterated that its same-store sales have risen “dramatically” ever since it began accepting Bitcoin payments about eight months ago.

In its post on X on Friday, the company said all Bitcoin sales are directed into its Strategic Bitcoin Reserve (SBR) and that it has now increased its Bitcoin stack by $10,000,000.

Founded in 1934, Steak ‘n Shake had also posted in late October to announce the creation of its Strategic Bitcoin Reserve (SBR). They said that all Bitcoin payments would be placed in the SBR. They also stated that 210 satoshi (sats) would be donated from every Bitcoin meal sold over 12 months to OpenSats Initiative, Inc., a nonprofit that funds open-source Bitcoin development and infrastructure.

Bitcoin (BTC) traded at about $95,138.87, down by 0.4% in the past 24 hours. On Stocktwits, retail sentiment around Bitcoin remained in ‘bullish’ territory, and the chatter levels stayed ‘normal’ over the past day.

Bitcoin Expansion And Muted Market Volatility

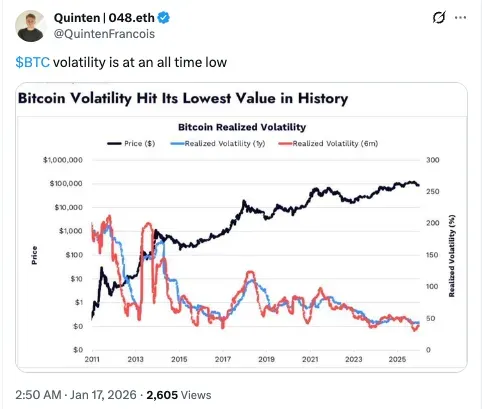

Stake ‘n Shake’s $10 million national Bitcoin-exposure increase comes at a time when Bitcoin’s volatility is at a record low. According to analyst Quienten Fracois, Bitcoin volatility is at an “all-time low.” BitBo’s Bitcoin Volatility Index showed a volatility estimate of 1.07% for the past month, which is consistent with a low volatility period.

Bitcoin’s all-time low volatility could be attributed to Wall Street and institutional adoption and regulatory clarity from Washington, especially as the market anticipates the markup of the crypto-market structure bill.

Read also: Bank of America CEO Warns Stablecoin Yields Could Negatively Impact Small Businesses

For updates and corrections, email newsroom[at]stocktwits[dot]com.<