The GST 2025 slab has changed tax rates on everyday essential goods and luxury products. This will save consumers for money. The price of everyday items will be low. The new system will be applicable from September 22.

GST reforms: The central government recently made a major improvement in GST (Goods and Services Tax). Two slabs of GST 12% and 28% were abolished. Now mainly two slabs are 5% and 18% left. Luxury products and panic items such as health damage items have been kept under 40% GST slab. After the changes in the GST rate, questions are being raised in the minds of the people that how much benefit was made compared to the earlier tax system. The central government has made easy arrangements to get an answer.

Scroll to load tweet…

How to know how much money is avoiding GST?

- Do you also want to know how much you are benefiting from the new GST system on expensive products like AC and fridge.

- If you are charged at the time of VAT, then you can visit https://savingswithgst.in/.

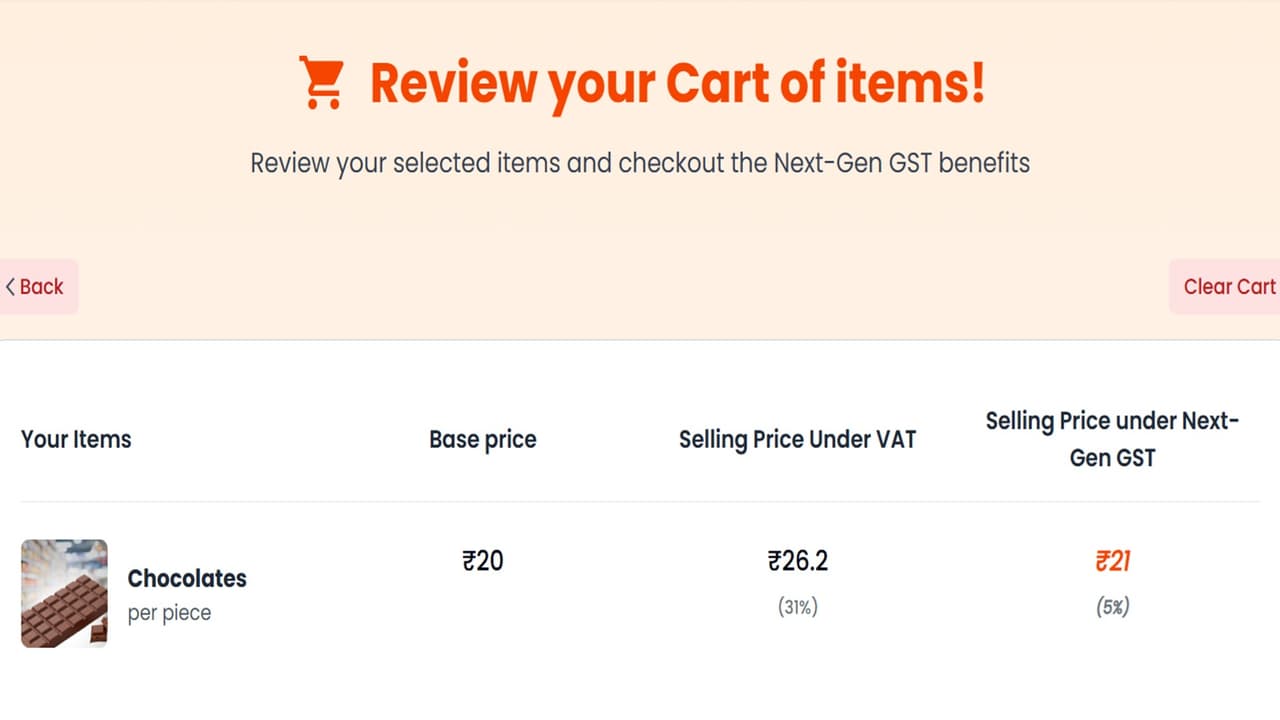

- By going to savingswithgst.in, you can choose the product of your choice from flour, sugar to chocolate or AC, fridge.

- Under the product you will get the option of Add to Cart. By clicking on it, the goods will be deposited in the cart.

- After this you have to click on the View Cart option.

- You will see the price of the goods you choose. After this, his base price will be seen. After this, the percentage of VAT and the price of the goods will be seen with it. In the end, it will be seen how much GST is being taken on that goods at this time and how much its price is.

Also read- New GST RATE LIST: From soap-shampoo to ghee-peak, these items used daily will be cheap