“It’s only after we’ve lost everything that we’re free to do anything.”- Chuck Palahniuk, Fight Club

On the surface, this line can sound like existence in chaos.

But read deeper, and it speaks to a truth seasoned investors hold dear. When markets crash, fear abounds, and portfolios run red-that’s when the boldest investment choices are taken. It’s during those very moments of doubt that genuine value lies silently revealed.

India’s metal industry has just entered one such crisis.

Early in FY25, the sector was in peak shape. Robust domestic demand and firm metal prices maintained performance firm, outlook upbeat, and investors grinning. But the wind changed quickly. The mood shifted with the US reciprocal tariff announcement.

Tariff woes and foreign market jitters hit hard. Metal stocks plunged-some dropped more than 18% over a week’s time. Optimism faltered, and pressures rose across the board.

And yet-this is the type of storm long-term metal stock investors tend to wait for. The industry has experienced steep declines like this before and also robust rebounds. What appears to be devastation now might be setting the stage for the next rally.

As Warren Buffett puts it, “The best chance to deploy capital is when things are going down.” And for investors looking at the metal sector, this could be that time. When stock prices fall because of short-term fear-not shattered fundamentals-it creates an opportunity to buy great businesses at wonderful discounts.

But finding genuine value through the wreckage takes more than intuition. That’s where the EV/EBITDA ratio comes into its own. Particularly in capital-intensive industries such as metals, it provides a better indication than raw profit figures.

It includes debt (which in this industry is usually considerable) and relates it to fundamental operating performance. It allows investors to sift out the hype and select companies that are actually undervalued.

In this article, we’ve done exactly that. Using the EV/EBITDA lens, we’ve shortlisted five of India’s cheapest metal stocks, all with a market cap above Rs 500 crore and positive EBITDA, that may deserve a closer look.

#1 Maithan Alloys

Maithan Alloys is engaged in the business of manufacturing and exporting of all three bulk Ferro alloys- Ferro Manganese, Silico Manganese and Ferro Silicon.

The current valuation of Maithan Alloys stands at an EV/EBITDA multiple of 2.5x, which reflects comparatively favorable pricing versus peers. It is currently trading below its 10-year median EV/EBITDA of 4.5x.

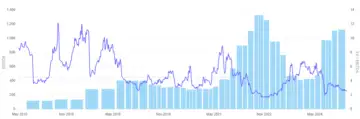

Maithan Alloys EV/EBITDA ratio over last 10 years Source: Screener.in

Source: Screener.in

On a closer examination of the chart we are able to see that Maithan Alloy’s EV/EBITDA multiple is trading nearly at par with 2020 EV/EBITDA multiples.

Moreover, Maithan Alloys’ EV/EBITDA multiple is presently nearly at levels of 2020. Nonetheless, the worst valuation occurred in 2022, when the multiple fell below 2x. Even though EBITDA has been stable, the recent fall in valuation indicates possible undervaluation.

Maithan Alloys continues to believe in long-term, sustainable growth, even in the face of global uncertainty. The company is dedicated to environmentally friendly production, R&D expenditure, and cost effectiveness, making it a strong player in a competitive global economy.

With India’s steel usage poised to increase and demand from automotive and infrastructure industries on the rise, Maithan is optimistic about future prospects. Their prudent financial policy, good credit rating, and niche product strategy puts them in a potentially good position to withstand future shocks.

As world steel and manganese demand grow, Maithan is well-positioned to take advantage of this upcycle.

#2 National Aluminium Company

Incorporated in 1981, National Aluminium Company (NALCO) manufactures and sells alumina and aluminium.

NALCO is priced at an EV/EBITDA multiple of 3.8 times, which puts it on the fair side of the valuation band in comparison to the other metal stocks. It is currently trading below its 10-year median EV/EBITDA of 5 times. This implies that the market is pricing in steady performance with growth prospects.

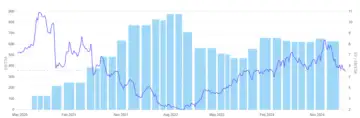

NALCO EV/EBITDA ratio over last 10 years Source: Screener.in

Source: Screener.in

Taking a closer look at the chart, the EBITDA of NALCO has consistently strengthened over the recent past, particularly after 2020, despite temporary dips in performance. The EV/EBITDA multiple indicates extreme volatility, touching a high of more than 12x in the latter part of 2023, but dropping dramatically to less than 4x lately.

Axis Securities has a buy recommendation on NALCO with a target of Rs 220, which suggests a 53.8% potential upside from the current market price of Rs 143 as of 10 April 2025.

The brokerage notes that NALCO is pursuing large-scale capacity expansion initiatives, such as the commissioning of a 1 million tonnes a year alumina refinery by FY26 and a 0.5 million tonnes a year aluminium smelter with a 1,200 MW captive power facility by FY30.

These initiatives will increase downstream production, enhance margin stability, and decrease reliance on external inputs-setting the company up nicely for long-term value creation and strategic self-reliance.

NALCO intends to become a vertically integrated aluminium player by using its own bauxite deposits and power-generation strengths. The management also highlighted its focus on sustainability, with proposals to make use of green energy and minimize its carbon footprint throughout operations.

It also aims to pursue new mining ventures and global partnerships, as part of its long-term strategy of self-sustained and globally scalable development.

#3 Vedanta

Vedanta is a diversified natural resource group engaged in exploring, extracting and processing minerals and oil & gas. The group engages in the exploration, production and sale of zinc, lead, silver, copper, aluminium, iron ore and oil & gas.

It has presence across India, South Africa, Namibia, Ireland, Liberia & UAE. Its other businesses include commercial power generation, steel manufacturing & port operations in India and manufacturing of glass substrate in South Korea and Taiwan.

Vedanta is trading at an EV/EBITDA multiple of 5 times, placing it among the better-valued players in the metal manufacturing industry. It is currently trading slightly above its 10-year median EV/EBITDA of 4.5 times. This valuation indicates the stock is fairly priced.

Vedanta EV/EBITDA ratio over last 10 years Source: Screener.in

Source: Screener.in

Upon closer inspection of the chart, Vedanta’s EBITDA has been fairly consistent over the years, even during the times of market volatility. This reflects operational stability in spite of macroeconomic fluctuations. One specifically saw a steep earnings decline around FY16, but since then, the company has presented a very strong turnaround, particularly post-2021.

Geojit has assigned a ‘Hold’ rating to Vedanta with a target price of Rs 496, which suggests an upside potential of 34.1% from the then-current market price of Rs 370 (as on 10th April 2025).

Looking forward, Geojit observes that Vedanta is concentrating on cost-effectiveness, strategic investments, and operational increases, like doubling BALCO’s rolled product capacity and advancing with refinery and smelter ramp-ups.

Vedanta management continues to be concentrated on long-term value creation by way of structural cost efficiencies and prudent capital allocation. The group is investing in aluminium, zinc, and power businesses as well as striving for self-reliance in strategic resources.

Leadership reiterated its dedication to deleveraging, streamlining its corporate structure, and sustainability as the fundamental pillars for long-term growth.

#4 Indian Metals and Ferro Alloys

Indian Metals and Ferro Alloys (IMFA) is a leading, fully integrated producer of Ferro Chrome in India which is primarily used in the production of stainless steel. It was set up in 1961.

It is trading at an EV/EBITDA multiple of 5.5 times, which places it among the reasonably-valued large-cap players in the metal space. It is currently trading at par with its 10-year median EV/EBITDA of 5.6 times.

India Metals and Ferro Alloys EV/EBITDA ratio over last 10 years Source: Screener.in

Source: Screener.in

A closer glance shows that India Metals and Ferro Alloys’ EV/EBITDA multiple had plummeted in mid-2022, falling below 3x even as EBITDA remained reasonably robust. Ever since, EBITDA has eased back marginally but still been in good health, with the EV/EBITDA ratio inching back towards its median band. The recent decline in valuation multiple, even with constant operating performance, suggests a likely mismatch between markets’ perception and fundamentals, which provides a good entry point on the long-run basis for balanced investors.

The firm is planning major expansion projects, including increasing its ferrochrome capacity two-fold within the next 3-4 years, underpinned by the Kalinganagar Phase-1 project that is slated to fire up in mid-FY27.

The company is also expanding chrome ore production with a view to reach 1.2 million tons from its Sukinda and Mahagiri mines by FY32.

It is venturing into ethanol manufacturing employing idle facilities at Therubali with the hope of Rs 300 crore revenues per year. With strong long-term deals, integrated operations, and no debt, IMFA seems well-suited for growth in the medium term even amid near-term headwinds.

#5 Prakash Industries

Prakash Industries is engaged in the business of manufacturing and sale of steel products and generation of power.

Prakash Indsutries is available at an EV/EBITDA multiple of 5.5 times, which represents a fairly priced valuation. It is currently trading above its 10-year median EV/EBITDA of 4.4 times.

Prakash Industries EV/EBITDA ratio over last 10 years Source: Screener.in

Source: Screener.in

A closer examination of the chart shows Prakash Industries’ EBITDA having recovered gradually since 2020 after a long dip after 2018. The EV/EBITDA multiple has been oscillating, reaching a high of more than 7x in 2023 but stabilizing since then at 5.5x.

In spite of the increase in valuation, the multiple today remains near long-term averages, reflecting a reset in investor expectations together with enhanced earnings clarity.

Prakash Industries is moving towards long-term independence via backward integration and control of resources. Its Bhaskarpara coal mining undertaking, set to start production soon after FY25, will help ensure steady cost-effectiveness in steelmaking.

The company also retains captive iron ore and coal connections, which provide it with strengthening integrated operations. Prioritizing sustainability, digitisation, and rural community uplift, Prakash strives to manage growth with a sense of responsibility.

These activities are made to support long-term competitiveness and operational resilience, placing the firm well for the next few years.

Conclusion

Even after the recent correction, most metal manufacturing companies still trade near or even slightly above their 10-year median EV/EBITDA multiples. This implies that although the stock prices may have fallen, investor confidence in the long-term fundamentals is largely intact.

Yet valuation is always a game of more than one metric. Whereas the EV/EBITDA multiple is a compelling place to begin-particularly for capital-intensive sectors such as metals-the investor must step back. A complete analysis should consider factors such as capital structure, cash flow quality, market positioning, industry dynamics, and management talent.

In turbulent industries such as metals, it’s not merely what a business makes, but how it’s constructed to endure the cycles.

Disclaimer

Note: We have relied on data from www.Screener.in throughout this article. Only in cases where the data was not available, have we used an alternate, but widely used and accepted source of information.

The purpose of this article is only to share interesting charts, data points and thought-provoking opinions. It is NOT a recommendation. If you wish to consider an investment, you are strongly advised to consult your advisor. This article is strictly for educative purposes only.

Ekta Sonecha Desai has a passion for writing and a deep interest in the equity markets. Combined with an analytical approach, she likes to deep deep into the world of companies, studying their performance, and uncovering insights that bring value to her readers.