While most investors chase trends and news, smart investors patiently eyeing what might be the next big opportunity. Nemish Shah, touted as a Warren Buffett of India, for his stock picking skills, earned the title by spotting potential where most see trouble.

Two of his favourite stocks are now trading at prices that should excite anyone focused on value investing. While the broader markets are inching upwards, these stocks are available at almost a 40% below their all-tie high prices. This shows a gap between market trends and the worth of the companies.

What keeps Nemish Shah steady when the market goes against their choices? The real question is not if these dips are just temporary. Shah’s investment outlook hints at a much deeper and more promising opportunity. Let us take a look at these stocks.

Elgi Equipments Ltd

Incorporated in 1960, Elgi Equipments Limited along with its subsidiaries, is in the business of manufacturing and supplying Air Compressors & Automotive Equipment, along with related after sales services.

With a market cap of Rs 15,871 cr, the company is the 6th largest air compressor manufacturer globally and the 2nd largest in India.

India’s true Waren Buffett Nemish Shah has been holding a stake in Elgi Equipments since December 2015 (as far as the data on Trendlyne.com shows). It would be fair to assume that he has owned this stake for a lot longer. Currently he holds 1.7% stake in the company which is worth almost Rs 270 cr.

Elgi Equipment’s current ROCE (Return on Capital Employed) is about 23%, which means for every Rs 100 the company invests as capital, it makes Rs 23 in profits on it.

The company’s sales were at Rs 1,863 cr for FY19 which jumped to Rs 3,218 cr for FY24, which is a compounded growth of 12% in 5 years. For 9MFY25, April to December 2024, the company has already recorded sales of almost Rs 2,518 cr.

The EBITDA (earnings before interest, taxes, depreciation, and amortization) for Elgi was Rs 194 cr in FY19 which has grown to Rs 491 cr in FY24, logging in a compound growth of about 20%. And for the 9 months between April and December 2024, the EBITDA logged in was Rs 375 cr.

The net profits grew from Rs 103 cr in FY19 to Rs 312 cr in FY24, which is a compound growth of 24%. And between April and December 2024, the profits recorded were Rs 249 cr.

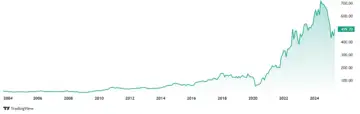

The share price of Elgi Equipments was around Rs 66 in May 2020, which in 5 years has jumped by 660% to its current price of Rs 501 (as on 28th May 2025). Just 1 lac in the company 5 years ago, it would today be over Rs 7.7 lacs.

At the current price, the stock is trading at about a 38% discount from its all-time high of Rs 800.

The company’s share is trading at a current PE of 49x, while industry median is 48x. The 10-year median PE for Elgi is 52x, while the industry median for the same period is a just 36x.

The company has maintained a strong dividend payout of 20% and has also managed to keep FIIs (Foreign Institutional Investors) interested in it, as they currently hold an impressive 29% stake in the company.

The Hi-Tech Gears Ltd

Incorporated in 1986, The Hi-Tech Gears Ltd is an auto components manufacturer primarily engaged in the business of manufacturing gears and transmission components.

With a market cap of Rs 1,170 cr, The Hi-Tech Gears Ltd has clientele which includes Hero MotoCorp Ltd, JCB, Cummins, Daimler Bharat, Tata, DANA, Mahindra, Wabco, Magna, etc

Shah has held a stake in Hi-Tech Gears atleast since December 2015 as per data on Trendlyne.com (earlier data is not available). Currently he holds 7.2% stake in the company worth Rs 86 cr.

As for the financials, the company’s sales jumped from Rs 914 cr in FY19 to Rs 1.107 cr in FY24 which is a compound jump of 4%. And between April and December 2024, the company logged in sales of Rs 712 cr.

EBITDA was Rs 113 cr in FY19 and in FY24 it jumped to Rs 150 cr, which is a 6% compound growth. For 9MFY24, the company has logged in Rs 103 cr in EBITDA.

Looking at profits, Hi-Tech Gears profits went from Rs 36 cr in FY19 to Rs 114 cr in FY24, logging a compound growth of 11%. And between April and December 2024, the profits are at Rs 36 cr.

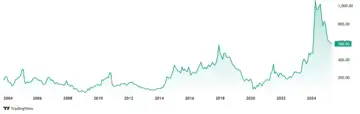

Hi-Tech Gears share price was around Rs 85 in May 2020 which has grown to its current price of Rs 623 (As on 28th May 2025), which is a jump of 634%. Rs 1 lac invested in the stock 5 years ago would be today around Rs 7.4 lacs.

At the current price of Rs 623, the company’s share is trading at a discount of 43% from its all-time high of Rs 1,094.

The share is trading at a PE of 24x, while the industry median is 27x. The 10-year median PE of Hi-Tech Gears is 24x which is the same as the industry median for the same period.

The company is focusing on improving asset utilization through targeted selling of existing capacity, higher customer engagement, and cost mitigation.

Buy of Watch from The Sidelines?

Nemish Shah’s favourite stocks that he has held for atleast a decade, Elgi Equipments and The Hi-Tech Gears make it clear that Shah is not one to run after trends and believes in the Buffett strategy of being invested for as long as possible. It speaks about conviction he has in these stocks.

And now that these stocks are 40% cheaper than their highest ever prices, makes them even more interesting to look at. And given the trajectory of Shah’s past investments, it is probably a good idea to keep a vigilant eye on these stocks.

Shah’s solid conviction and faith in these stocks makes one think if there is something in these stocks that an average investor is oblivious to. What is the hidden secret here? We will only know in time. For now, these picks by Shah are ones to watch, so adding them to the watchlist could prove to be beneficial.

Disclaimer:

Note: We have relied on data from www.Screener.in and www.trendlyne.com throughout this article. Only in cases where the data was not available, have we used an alternate, but widely used and accepted source of information.

The purpose of this article is only to share interesting charts, data points and thought-provoking opinions. It is NOT a recommendation. If you wish to consider an investment, you are strongly advised to consult your advisor. This article is strictly for educative purposes only.

Suhel Khan has been a passionate follower of the markets for over a decade. During this period, He was an integral part of a leading Equity Research organisation based in Mumbai as the Head of Sales & Marketing. Presently, he is spending most of his time dissecting the investments and strategies of the Super Investors of India.