Consistency in earnings often gives a clearer picture of a company’s direction than one strong quarter. In a market where quarterly numbers are closely tracked, a few companies have reported four consecutive quarters of profit growth.

This kind of pattern doesn’t guarantee future performance, but it can reflect some stability in operations, demand, or margins. It also suggests the companies aren’t relying on one-off gains or accounting adjustments.

We’ve shortlisted three such stocks that have shown a stable profit trend over the past year. Let’s take a look..

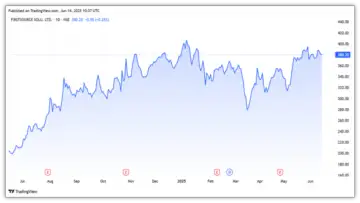

#1 Firstsource Solutions

Firstsource Solutions, a part of the RP-Sanjiv Goenka Group, is a global business process management company offering end-to-end customer lifecycle management. It operates across telecom, media, banking & financial services, and healthcare sectors.

With a long-standing presence in the international markets, Firstsource generates more than 99% of its revenues from the USA and UK markets.

Strong topline growth, stable margins

In FY25, revenue increased 26% from last year to Rs 79.8 billion. While, EBIT margin remained flat at 11%, strong revenue growth led to a 15.5% rise in net profit to Rs 5.9 billion. This is the fourth consecutive quarter of sequential and year-on-year revenue and profit growth. EBIT refers to earnings before interest and tax.

Healthcare was a big growth driver, growing 30% YoY in FY25, while BFSI grew 12%, and media grew 12%. Return on Equity (RoE) and Return on Capital Employed (RoCE) remained modest at 14.5% and 15.6%, respectively. The company also generated free cash flow of Rs 4.8 billion during the year.

Strong Growth led by Client Diversification

Over the last four quarters, Firstsource added thirteen clients with over $1 million in revenue, five with over $5 million, and two with over $10 million. This expansion has supported revenue diversification, as seen in the decline in revenue share from the top client. Top 5 clients contributed 29.4% (down from 36.4% a year ago), and top 10 clients contributed 43.7% (down from 52.6%).

Looking ahead, First Source expects a constant currency revenue growth of 12-15%, with an EBIT margin of 11-12% in FY26. This growth will be driven by new deal wins.

Firstsource secured a total of 14 large deals in FY25, which they define as deals with an Annual Contract Value (ACV) of over $5 million. This included five large deals signed in Q4FY25. Of these, four deals were over $10 million in ACV-the highest number in the company’s history. The strength and scale of these deals are attributed to deep industry and functional expertise, partnerships across the technology ecosystem, and active integration of automation and AI. The management stated that AI and other emerging technologies have the potential to reshape the BPO industry.

From a valuation standpoint, it trades at a price-to-equity (P/E) multiple of 46x, which is well above the 10-year median of 14x.

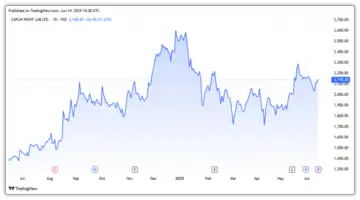

#2 Caplin Point Laboratories

Caplin Point is a contract manufacturer of generic products. It has a diversified product portfolio, with over 4,000 registered products and 650+ pharma formulations. Its product mix covers over 65% of the WHO’s essential drugs test.

Caplin covers a wide range of pharmaceutical formulations and therapeutic areas in 23 countries. However, it operates primarily in Latin America and Francophone Africa.

It ranks among the top Indian pharma companies in terms of research and development (R&D) spend as a percentage of revenue over the past five years. It spends about 4-5% of its operating revenue on R&D. The company manufactures 60% of its products in-house and outsources 40% to partners in India and China. Caplin believes this diversification helps it de-risk against cost escalations, currency fluctuations, and other headwinds.

Strong Financial Performance

Revenue rose 14% to Rs 19.4 billion in FY25. The generic segment accounted for 75% of the revenue, followed by the branded generic (25%). Geographically, 76% of revenue came from Latin America, 18% from the US, and the remaining 6% from Africa.

EBITDA margin expanded 1.4 percentage points to 36.5%, leading to a 17% surge in net profit to Rs 5.4 billion. The company has been consistently reporting sequential and year-over-year revenue and profit growth for over four quarters now.

Return ratios remained healthy with RoCE and RoE at 26% and 21%, respectively. EBITA refers to earnings before interest, tax, and depreciation.

Capex Plan and Business Expansion

Looking ahead, the company is expanding beyond generics to complex product segments. It has allocated about Rs 1,000 crores of investment, of which around 50% is nearing completion. The balance will be spent over the next 2 3 years.

The investment is aimed at enhancing production capacity and expanding the product portfolio. The company expects 10-12 new drug approvals in FY26, which could lead to strong top and bottom-line growth. It has also launched its first ready-to-use bag, first ophthalmic emulsion, and first injectable emulsion product.

Growth Triggers Ahead The key trigger for Caplin will be the commissioning of multiple facilities, expected to go live gradually through FY27. Caplin Plant I in Puducherry and the Oncology facility in Chennai are expected to be completed in Q1FY26.

Another Oncology/API facility will go live in Q3/Q4FY26. An oral solid dosage facility in Chennai is expected to be completed by Q4 FY26, with another plant targeted for Q4 FY27.

Caplin’s core business in Latin America and Francophone Africa is expected to grow at a steady pace with industry-average margins. In parallel, it is now eyeing other markets such as Canada, Australia, the Middle East, North Africa, and Latin America, in the near to medium-term horizon.

Valuation-wise, it trades at a P/E of 30x, a 27% premium to the 10-year median of 22x.

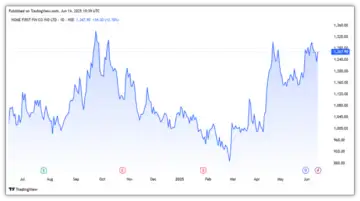

#3 Home First Finance

Home First is an affordable housing finance company with a pan-India presence. It serves first-time home buyers with a monthly income of over Rs 50,000. Its assets under management (AUM) stood at Rs 127 billion in FY25. Housing loans form 84% of the AUM, with an average ticket size of Rs 1.2 million.

The company is geographically well-diversified, with a presence in 13 states. Gujarat accounts for 29% of gross loan assets, followed by Maharashtra (13.3%), Tamil Nadu (13%), Telangana (8.5%), and Madhya Pradesh (8.2%).

Disbursements and Loan Mix

In FY25, disbursements increased by 21% to Rs 48 billion, resulting in a 31% rise in AUM. In terms of loan mix, housing loans constitute 84% of AUM, followed by loans against property (15%) and shop loans.

Around 68% of borrowers are salaried, while 32% are self-employed. The borrower base is relatively low-risk, with an average credit score of 746. The company also boasts a strong collection efficiency of 99.4%.

Strong All-Round Performance

Driven by strong AUM and disbursements, net interest income surged 20% to Rs 5.7 billion. However, the net interest margin fell to 5.2% from 5.8% due to higher costs of funds. Net profit rose 25% to Rs 3.8 billion. It has recorded sequential and year-on-year profit growth for over 4 quarters so far.

Return on assets declined slightly by 30 basis points to 3.5%, while return on average equity improved by 100 basis points to 16.5% in FY25.

Credit quality remained healthy, with gross non-performing assets (NPAs) at 1.7% (constant year-on-year) and net NPAs at 1.3%. However, credit cost increased 13% to Rs 2.8 billion, primarily led by a 10 basis point increase in net NPAs.

Strong Growth Outlook Looking ahead, growth in AUM is expected to be driven by expansion in markets such as Andhra Pradesh, Uttar Pradesh, Tamil Nadu, Madhya Pradesh, and Rajasthan. The company plans to add 30 to 40 branches each year.

It currently holds a 2% market share in affordable housing and aims to achieve a 4-5% share within 3-5 years. It expects AUM to grow by 26-30%, driven by a 20-25% increase in disbursement.

It trades at a price-to-book multiple of 4.5x, slightly above its 4-year median of 4.2x. The company has a limited trading history, as it debuted about 4 years ago.

Conclusion

Profit growth is among the most credible metrics for evaluating a company’s performance. Usually, year-on-year growth is considered strong, but if it’s also consistent on a sequential basis, it indicates sustained business momentum. First Source is leading, backed by high-value client additions, while Home First and Caplin Point are benefiting from strong demand in real estate and contract manufacturing, respectively. However, on the valuation front, Firstsource trades well above its long-term median, while the other two are closer to their median valuation.

Disclaimer

Note: Throughout this article, we have relied on data from https://www.Screener.in and the company’s investor presentation. Only in cases where the data was not available have we used an alternate but widely used and accepted source of information.

The purpose of this article is only to share interesting charts, data points, and thought-provoking opinions. It is NOT a recommendation. If you wish to consider an investment, you are strongly advised to consult your advisor. This article is strictly for educational purposes only.

About the Author: Madhvendra has been deeply immersed in the equity markets for over seven years, combining his passion for investing with his expertise in financial writing. With a knack for simplifying complex concepts, he enjoys sharing his honest perspectives on startups, listed Indian companies, and macroeconomic trends.

A dedicated reader and storyteller, Madhvendra thrives on uncovering insights that inspire his audience to deepen their understanding of the financial world.