Ask any long-term investor what they value more: high returns or consistency. Most would say both. However, finding companies that deliver consistent stock returns and share a portion of their profits regularly is rare.

Many firms either prioritize growth and reinvest everything back, or focus on payouts but compromise on performance.

Over the last decade, only a handful of companies have managed to strike the right balance. Two such names have quietly compounded wealth, year after year, while consistently paying dividends. The question is-can this track record continue?

Let’s examine how these businesses have created value and whether they can remain dependable in a changing market environment.

Incorporated in 1990, Persistent Systems provides software and technology services.

Its offerings include software product engineering, cloud and infrastructure, enterprise information technology security, enterprise integration, application development, data analytics, and artificial intelligence.

The company caters to various industries, including banking, financial services and insurance (BFSI), healthcare and life sciences (HLS), software and hi-tech, and telecom and media.

Software and Hi-Tech lead the revenue mix with a 41% contribution, followed by 32% from BFSI and 27% from healthcare and life sciences.

Persistent serves global clients, including Fortune 500 firms, and offers proprietary software frameworks to accelerate integration and acceleration. It has partnered with industry leaders, including Salesforce, IBM, Google, Microsoft, and AWS.

Geographically, 81% of its revenue comes from North America, followed by India (9%), Europe (8%), and the rest of the world (2%). The company’s revenue is well-diversified.

Its top 5 clients contribute 31% of revenue, while the top 10 and top 20 contribute 41% and 52%, respectively. Persistent has four clients with annual deal sizes exceeding $75 million and 55 clients generating over $5 million each.

20th Consecutive Quarter of Positive Sequential Growth

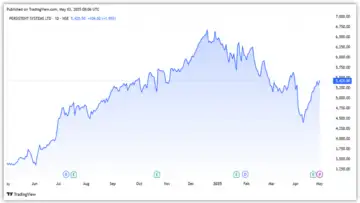

Persistent performance has accelerated growth meaningfully since FY21, after Sandeep Kalra (an HCL Tech veteran) was appointed CEO in 2019. Since then, the company’s revenue has grown at a compounded annual growth rate (CAGR) of 30% to ₹119.4 billion in FY25. The company posted its 20th consecutive quarter of positive sequential growth in Q4FY25.

Despite a subdued demand environment across the broader sector, Persistent’s revenue increased 22% in FY25. EBITDA margins remained steady at around 17%. Net profit rose at a 32% CAGR to ₹14.0 billion in FY25, marking a 28% jump from FY24. EBITDA stands for earnings before interest, tax, depreciation, and amortization.

The BFSI, healthcare, and life sciences sectors primarily fueled this growth. Geographically, performance was strong across all key regions, including North America and Europe.

The company also maintains strong return ratios. As of Q4FY25, return on capital employed (RoCE) and return on equity (RoE) stood at 40% and 25%, respectively.

This shows a strong ability to generate returns. Per the Persistent Investor Presentation, since its IPO in 2010, the stock has delivered a 70x return, supported by a healthy payout (175% dividend yield).

If you had invested ₹0.8 million 10-year backs, you would have amassed ₹12 million by now, including a dividend of ₹0.34 million. As per Value Research, this translates to a CAGR of 30%.

Ambitious Outlook

Looking forward, Persistent has set an ambitious mid- and long-term goal of achieving revenue of $2 billion by FY27, up from about $1.4 billion in FY25. Over the long run, it aims to reach revenue of $5 billion by FY31, implying a CAGR of over 24%.

The company plans to concentrate on its top 100 clients, enhance global capability centers, and integrate AI to meet these goals. Moreover, it has a robust order book and pipeline to maintain its growth momentum.

Persistent is also positioned as a leader in disruptive technologies, focusing on artificial intelligence. It has developed platforms such as GenAI Hub, which offers clients access to generative AI solutions, and iAURA, an AI-powered data tool for decision-making.

Valuation at Premium

Currently, Persistent is trading at a price-to-earnings (PE) multiple of around 60x, higher than the 10-year median PE of 21x. Relatively too, it trades at a premium to LTIMindtree (30x), Infosys (24x), and Mphasis (28x).

Stronger earnings growth has made the valuation rich. Motilal Oswal values the company at 45x FY27E earnings per share and reiterates a buy with a target price of ₹6,450, 18% higher than the current price of ₹5,425.

Established in 1959, Pidilite is a market leader in consumer and specialty chemicals. It holds a dominant position in the consumer adhesives and sealants market. In addition to Fevicol, Pidilite owns several well-known brands such as Steelgrip, Dr. Fixit, M-Seal, and Fevikwik.

The company has successfully leveraged its brand equity to push new products and strengthen its market position. Moreover, its ability to customize its product portfolio gives it a competitive edge.

Consumer and Bazaar Segments Dominate

Pidilite operates through two business segments. The Consumer and Bazaar (C&B) segment, which includes adhesives, sealants, and paint chemicals, contributes 82% to revenue. The Business-to-Business (B2B) segment, accounting for 18%, includes industrial adhesives and pigments.

In the product mix, adhesives and sealants contribute 55.5% of revenue, followed by construction and paint chemicals at 21%. Industrial resins and construction chemicals contribute 8.4%.

Consistent Financial Performance

Pidilite has delivered consistent growth owing to its strong product portfolio. Revenue grew at a 15% CAGR during FY20-24 to reach ₹111.2 billion in FY24. This reflects a growth of 5.4% over FY23, driven by healthy volume growth.

Net profit grew at a CAGR of 11.5% during the period to ₹17.9 billion in FY24. A sharp fall in input costs led to a 5.3 percentage point improvement in EBITDA margin to 22.9%, driving a 43% YoY profit growth in FY24.

Pidilite continues to deliver robust return ratios. The return on average net worth and RoCE stood at 23.2% and 30%, respectively, showing operational efficiency.

An investment of ₹0.8 million made 10 years ago would be worth ₹4.2 million today, including dividends of ₹0.13 million. As per Value Research, this translates to a CAGR of 18%.

Revenue in 9MFY25 rose 5.5% to ₹99.6 billion, with margin improving further by one percentage point to 23.9%. As a result, net profit increased 15.6% to ₹16.7 billion, aided by lower costs. A slowdown in urban demand has been impacting its revenue growth.

Looking ahead, Pidilite is expected to see strong growth in new categories such as waterproofing and tile jointers. It also plans to deepen its presence in international markets across South and South-East Asia, Central Africa, and select Middle Eastern countries.

Short-Term Challenges Persist, But Recovery Likely in FY26

As highlighted in its 2025 analyst day, it has structured its portfolio into core, growth, and pioneers segments to drive strategic expansion.

The Core segment, expected to grow 1-2x GDP, focuses on premiumisation and innovation. The Growth segment, projected to grow at 2-4x GDP, includes high-potential brands such as Dr. Fixit and Roff. The Pioneer segment includes newer brands such as Unofin and Haisha, aims to generate revenues of ₹1 billion within three years of launch.

A decade ago, 80% of Pidilite’s revenue came from core categories. Today, the contribution has shifted to a more balanced mix-52% from core and 48% from growth segments. The company aims to maintain a balanced mix of 50:50, ensuring diversified growth and a future-ready business model.

Long-term growth drivers remain strong, backed by infrastructure expansion, domestic manufacturing, electronics, and green energy sectors. However, near-term growth challenges persist due to softness in demand. Nonetheless, the company anticipates a pickup from 2HFY26.

Valuation at Slight Premium

From a valuation perspective, Pidlite trades at a P/E of 76x, about a 10% premium to the 10-year median PE of 69. Motilal Oswal has a neutral rating on the stock and a target price of ₹2,950 per share, indicating limited upside from current levels.

Conclusion

Both Persistent and Pidilite Industries have outperformed the broader market and have generated strong returns for long-term patient investors. Persistent is going strong and has an ambitious target of $5 billion in revenue by FY31. While Pidilite faces near-term headwinds, but has still delivered strong profit growth due to easing input costs. Nonetheless, both are still at a sweet spot in their respective industries over the long run.

Disclaimer:

Note: Throughout this article, we have relied on data from https://www.Screener.in and the company’s investor presentation. Only in cases where the data was unavailable have we used an alternate but widely used and accepted source of information.

The purpose of this article is only to share interesting charts, data points, and thought-provoking opinions. It is NOT a recommendation. If you wish to consider an investment, you are strongly advised to consult your advisor. This article is strictly for educational purposes only.

About the Author: Madhvendra has been deeply immersed in the equity markets for over seven years, combining his passion for investing with his expertise in financial writing. With a knack for simplifying complex concepts, he enjoys sharing his honest perspectives on startups, listed Indian companies, and macroeconomic trends.

A dedicated reader and storyteller, Madhvendra thrives on uncovering insights that inspire his audience to deepen their understanding of the financial world.