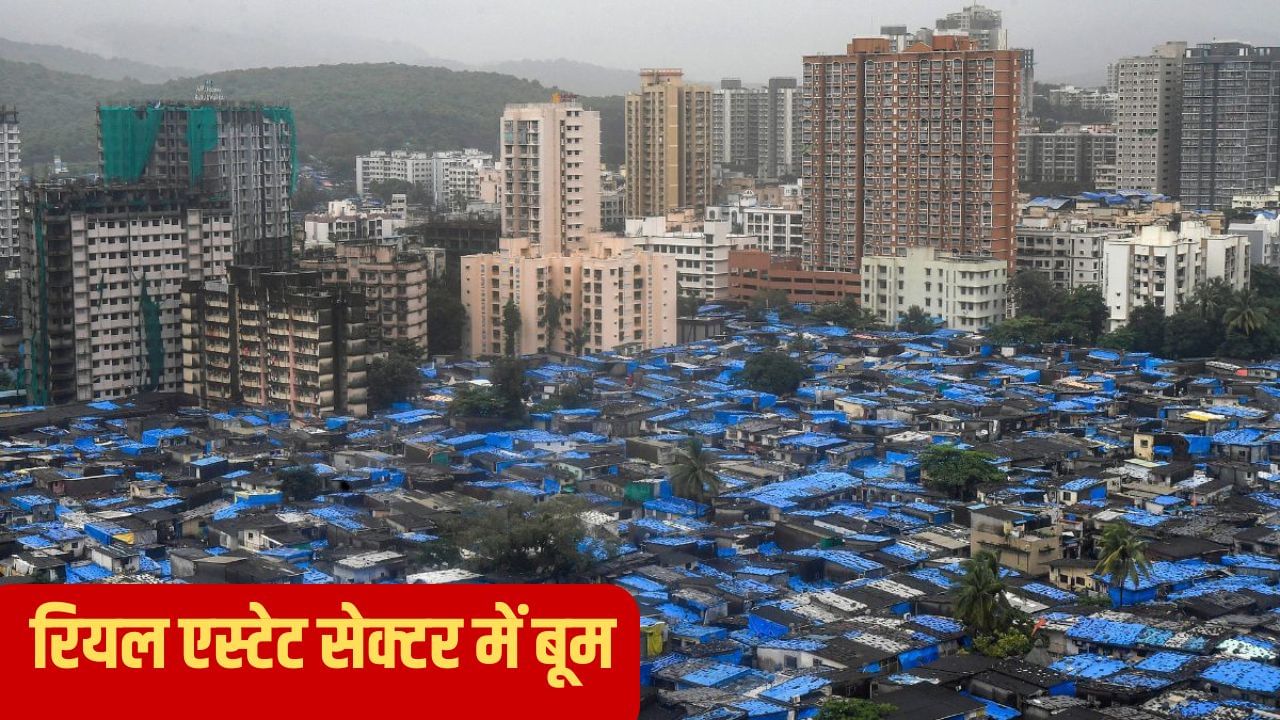

real estate sector

There is a continuous growth in the real sector in the country. Investor interest in this sector has increased. Driven by the office, retail and warehousing sectors, India’s real estate investment trust (REIT) market is projected to grow from Rs 10.4 trillion in 2025 to Rs 19.7 trillion by 2030, according to a recent Knight Frank India report. The report says that India’s office market has exceeded 1 billion square feet, which is the fourth largest space globally.

The Possibilities Built, Opportunities Now report on commercial real estate says India’s REITs have the potential to diversify beyond traditional asset classes like office, retail and storage into industrial parks, data centers and hospitality sectors. Listed REITs offer a stable average annual dividend yield of around 5.5 per cent, making them attractive income-generating tools.

This report was released on October 31 at the Confederation of Indian Industry (CII) conference on the topic Evolving Landscape of Indian Real Estate – CRE, Unlocking Investment, Opportunities and Economic Growth. Knight Frank data showed that there are currently five listed REITs in India covering approximately 177 million square feet of commercial and retail space, including operational, under-construction and upcoming properties, valued at approximately Rs 2.3 trillion and over 290,000 unitholders.

Valuation will increase by this much

Viral Desai, Senior Executive Director (Occupier Strategy & Solutions, Industrial & Logistics, Capital Markets & Retail Agency), Knight Frank India, said that India’s commercial real estate has moved from promise to performance. He said that as the size of REITs is expected to increase from Rs 10.4 trillion to Rs 19.7 trillion by 2030, there will be a need to focus on quality supply, sustainability and global-standard asset management. The real opportunity lies in converting this built momentum into long-term, inclusive economic value. The value of REIT-eligible office properties is expected to increase from Rs 8.2 trillion in 2025 to Rs 16 trillion by 2030.

Similarly, in the retail sector, out of 66 million square feet of Grade A stock, only 7.3 million square feet of Grade A stock is under REITs, showing ample scope for institutional expansion. Due to rising consumer demand and the trend towards formal retail formats, the value of REIT-eligible retail properties is expected to grow from Rs 1.5 trillion by 2025 to Rs 2.4 trillion by 2030.