Traders floated scenarios ranging from a $20 billion buyout to a potential partnership with UnitedHealth, reviving Viking’s long-standing takeover chatter.

- Traders floated scenarios ranging from a $20 billion buyout to a potential partnership with UnitedHealth, reviving Viking’s long-standing takeover chatter.

- The renewed speculation followed Pfizer’s win over Novo Nordisk for the obesity drug maker Metsera, sparking fresh focus on independent biotech players.

- Some retail users argued Viking could achieve a $50 billion market cap on its own, calling it a “10x opportunity” over the next five years.

Viking Therapeutics shares hit a three-month high on Tuesday as retail traders on Stocktwits reignited takeover speculation following Pfizer’s win over Novo Nordisk in the bidding war for Metsera. The renewed buzz centered on the possibility of a $20 billion buyout or a potential UnitedHealth partnership, with some users arguing Viking could remain independent and still reach a $50 billion valuation.

Traders Revive Familiar Buyout And Merger Talk

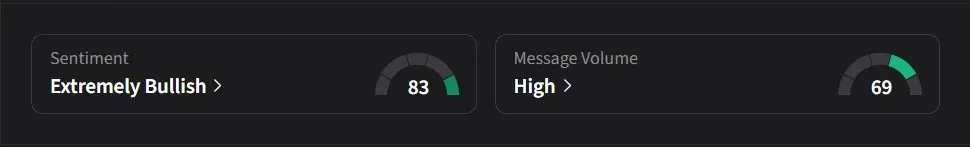

Retail traders on Stocktwits weighed fresh scenarios for Viking, long a favorite among biotech investors for takeover speculation, with sentiment described as ‘extremely bullish’ amid ‘high’ message volume.

One retail trader said that Viking CEO Brian Lian “has an offer in his hand,” though its value is uncertain, adding that $15 billion to $20 billion should do it. The user urged long-term holders to hold their shares and said they were “hoping the best for all of us longs that have hung in with Viking.”

UNH Merger Scenario Gains Momentum

Another user said that a potential partnership or merger with UnitedHealth would “revolutionize how small bio deals get done.” The post suggested such a deal would cut out the middleman and “increase profits by offering an in-house option.

A separate user added that Eli Lilly might have to make an offer as a defense mechanism if UnitedHealth were to move first. They said the UNH scenario “makes total sense for a huge insurer,” claiming it could “save them tens of billions a year” and that such a move would also “literally crush” Lilly’s stock price.

Pfizer–Novo Deal Reignites M&A Buzz

The revived speculation followed Pfizer’s victory over Novo Nordisk in the bidding war for Metsera, a smaller obesity-drug developer. Novo confirmed earlier this month that it lost its $10 billion pursuit after Pfizer’s final offer was accepted.

The outcome has renewed investor focus on other independent obesity drug developers, such as Viking, which traders see as a logical next target for large-cap pharmaceutical firms. Novo CEO Mike Doustdar recently told executives the company would continue exploring complementary deals in obesity and diabetes.

Standalone Growth Seen As A 10x Opportunity

One user argued that Viking should remain independent, saying its dual obesity and MASH pipelines could deliver substantial long-term upside. They said Viking’s peak sales are conservatively north of $10 billion across its programs, and that applying standard market multiples yields a $50 billion-plus market cap. The user described holding Viking as a “10x opportunity” over five years compared to “jumping from stock to stock” for small short-term gains.

‘Somebody Knows Something’

Another watcher said they have followed Viking from the past few years and that this latest rally “seems different,” adding, that most times it’s rumors and such, but this time it feels like somebody knows something.” The user said the stock’s momentum could be tied to “good results coming out or merger/buyout news,” noting that when obesity drugs were most hyped, Viking “rocketed to around $90 on good results.”

Viking’s stock has risen 0.9% so far in 2025.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<