Stocktwits sentiment for OPEN has remained in the ‘extremely bullish’ zone so far this week.

- OPEN’s bullish backers took to social media to praise the company and moves by CEO Kaz Nejatian.

- Nejatian and Chief Growth Officer Morgan Brown are purchasing the company’s stock this week.

- Stocktwits sentiment for OPEN has remained in the ‘extremely bullish’ zone so far this week.

Bullish backers of Opendoor Technologies, Inc. cheered the stock’s recent gains and insider purchases, seeing them as signs that the digital real estate platform is poised for long-term success despite a poor quarterly showing.

“$OPEN finished +6.4% today after +20% yesterday and +30% off Friday’s pre-market lows. That’s +77% since 5am Friday,” EMJ Capital founder Eric Jackson, who has been instrumental in the stock’s rally this year, posted on X.

“Meanwhile, guys like George Noble were on X Thursday night and Friday morning, celebrating a funeral that never happened. Turns out… They were dancing on their own credibility. We don’t trade hourly candles. We build dynasties. Road to $82 continues,” said Jackson, implying a nearly 10-fold jump in OPEN’s stock from the last close.

Jackson’s comments took a swipe at hedge fund manager George Noble, who posted on X that OPEN is “grossly overpriced” based on a BTIG note that questioned the company’s offensive strategy of “buying more homes faster at better margins.”

Noble, a former associate of the legendary Peter Lynch, posted a series of comments critical of Opendoor in recent days, stating in one post that a bull case lacks a thorough financial analysis.

Notably, Jackson’s bullish comments in July sparked a multifold surge in Opendoor’s shares, prompting what many believed was a renewed “meme stock” frenzy.

Crypto investor Anthony Pompliano, who disclosed a position in Opendoor in August, echoed Jackson’s view, calling certain analysts betting against the company “spreadsheet monkeys.”

“They don’t realize it yet, but you can’t measure a company’s soul being reincarnated in a spreadsheet. Never bet against missionaries,” he posted on X.

Insider Purchase & Retail Momentum

Meanwhile, after CEO Kaz Nejatian said his family is buying $1 million worth of company shares on Tuesday, Chief Growth Officer Morgan Brown shared an image showing a stock purchase of over $100,000. “We believe in homeowners, we believe the future is OPEN. We’re all in,” Brown wrote in the X post.

On Stocktwits and X, users flagged that the company had updated its investor page and shared a screenshot showing Opendoor’s weekly contract acquisitions were up 25%. To one of those posts, Nejatian responded with the caveat that there will also be weeks when growth is weak: “but we will keep executing.”

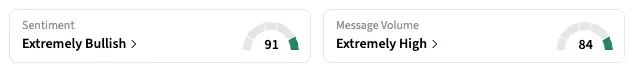

Retail sentiment for OPEN on Stocktwits remained ‘extremely bullish,’ unchanged since late Friday last week, with ‘extremely high’ message volume as of late Tuesday.

“$OPEN she’s a 10 bagger from here, folks. Get in,” exclaimed one bullish Stocktwits user.

All considered, bulls are back to rallying behind Opendoor after weak quarterly results last week dampened investor sentiment.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<