Oppenheimer anticipates the company could approach 70% margins in the next few years as operational efficiencies improve.

- Oppenheimer upgraded Ondas’ stock to ‘Outperform’ from ‘Perform’.

- Demand for Ondas’ On-Air Solutions (OAS) platform remains robust, said Oppenheimer.

- The company’s Q3 earnings surpassed analysts’ consensus estimates.

Ondas Holdings Inc. (ONDS) drew the spotlight on Friday after Oppenheimer upgraded the stock to ‘Outperform’ from ‘Perform’ with a $12 price target. The move follows the company’s report of a substantial increase in third-quarter revenue.

The company’s third-quarter (Q3) revenue of $10.1 million and loss per share (EPS) of $0.03 both came in better than the analysts’ consensus estimate of $7.04 million and a loss of $0.05, respectively, according to Fiscal AI data.

Financial Strength

Oppenheimer highlighted that Ondas’ Q3 revenue was more than six times the level from the same period in the previous year. Gross margins reached 26%, and the firm anticipates the company could approach 70% margins in the next few years as operational efficiencies improve.

The company is entering this growth phase with a strong balance sheet, holding $840 million in pro forma cash, the firm stated.

Demand for Ondas’ On-Air Solutions (OAS) platform remains robust, with an all-time high backlog of $22.2 million. Oppenheimer highlighted that this momentum underscores market confidence in the company’s offerings and growth trajectory.

How Did Stocktwits Users React?

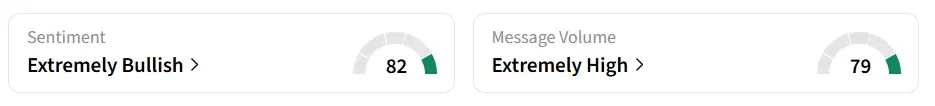

Ondas’s stock traded over 14% higher on Friday mid-morning. On Stocktwits, retail sentiment around the stock remained in ‘extremely bullish’ territory. Message volume improved to ‘extremely high’ from ‘high’ levels in 24 hours.

A Stocktwits user lauded the company’s business execution plan.

The company also raised its revenue forecast for the full year 2025. It now expects the fiscal year’s revenue to come in at a minimum of $36 million, up from its previous guidance of $25 million.

ONDS stock has gained over 199% in 2025 and over 931% in the last 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<