Brent crude prices rose 1.4% to $63.90 per barrel at the time of writing, while West Texas Intermediate crude prices gained 90 cents, closing in on $60 per barrel.

- The Ukrainian attack took place on an oil depot in the Russian Black Sea port of Novorossiysk.

- According to a Bloomberg News report, Goldman analysts suggested that oil demand could rise to 113 million barrels per day in 2040, compared with 103.5 million in 2024.

- Goldman reportedly attributed the roadblocks to low-carbon technology and infrastructure adoption, along with rising energy demand, to the updated outlook for fresh growth projections.

Oil prices gained on Friday after Ukraine reportedly launched a drone attack on an oil depot in the Russian Black Sea port of Novorossiysk.

According to a Reuters News report, citing Russian officials, the attack took place early on Friday. Alongside the oil depot, it damaged apartment buildings, a ship in port, injuring three crew members of the vessel. Brent crude prices rose 1.4% to $63.90 per barrel at the time of writing, while West Texas Intermediate crude prices gained 90 cents, closing in on $60 per barrel.

The attacks come amid fresh U.S. sanctions on Russian oil firms Lukoil and Rosneft, to cut Moscow’s lucrative oil revenue and put pressure on Russian President Vladimir Putin to go to the negotiating table over the war in Ukraine. The sanctions will prevent firms from doing business with the Russian companies after Nov. 21.

After IEA, Goldman Sachs Turns More Bullish

Goldman Sachs analysts reportedly predicted global oil demand would rise for longer than previously estimated, following a report by the International Energy Agency that introduced a scenario in which oil demand would increase until 2050.

According to a Bloomberg News report, Goldman analysts suggested that oil demand could rise to 113 million barrels per day in 2040, compared with 103.5 million in 2024. Last year, the analysts predicted global oil demand would peak by 2034, but also flagged the potential for growth to top out six years later due to slow electric-vehicle adoption.

Goldman reportedly attributed the roadblocks to low-carbon technology and infrastructure adoption, along with rising energy demand, to the updated outlook for fresh growth projections. The bank said petrochemicals will be a driver of oil consumption after a long plateau in road transport, with strong contributions from aviation.

“We do not assume major breakthroughs in low-carbon technology,” Goldman’s analysts stated. “Even for peaking road oil demand, we expect a long plateau after 2030,” and trucks powered by liquefied natural gas are unlikely to take off outside of China, they added.

What Are Stocktwits Users Thinking?

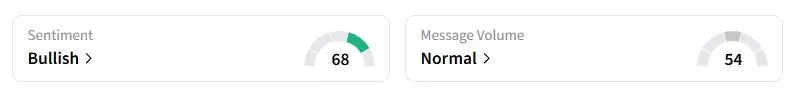

Retail sentiment on Stocktwits about the United States Oil Fund was in the ‘bullish’ territory at the time of writing.

Despite the positive signs of long-term demand, the IEA warned Thursday that the global oil market is heading toward a major oversupply in 2026, projecting a surplus of up to 4.09 million barrels per day as output from OPEC+ members and other producers continues to rise while demand growth weakens.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<