Jason Furman, Professor of Economics at the Harvard Kennedy School, said on Friday that the U.S. government’s 43-day shutdown subtracted 1.15 percentage points from the Q4 GDP.

- On Friday, The Bureau of Economic Analysis revealed that the U.S. economy clocked an annualized growth rate of 1.4%, missing the Dow Jones forecast of 2.5%.

- The economist noted that nominal federal spending fell by $4 billion in Q4, declining to a 3.5% annualized rate.

- However, he said that the real federal spending fell at a 16.6% annualized rate, placing the drop in the first percentile of real growth since 1948.

Jason Furman, Professor of Economics at the Harvard Kennedy School (HKS), said on Friday that the U.S. government’s 43-day shutdown shaved off a significant portion of the fourth-quarter (Q4) growth.

In a post on X, Furman called the longest shutdown in American history that began in Oct. 2025 “wasteful,” adding that it subtracted 1.15 percentage points from the Q4 gross domestic product (GDP).

“Overall this subtracted 1.15 pp from GDP growth in Q4, so it would have been 2.5% absent this but instead was 1.4%,” he said.

Earlier on Friday, The Bureau of Economic Analysis (BEA) revealed that the U.S. economy clocked an annualized growth rate of 1.4%, missing the Dow Jones forecast of 2.5%.

The Differential Explained

The economist noted that nominal federal spending, covering consumption and investment but excluding transfers, fell by $4 billion in Q4, not annualized, or declined to a 3.5% annualized rate. He added that this was a notable drop, around the 14th percentile of growth since 1948, though not too dramatic.

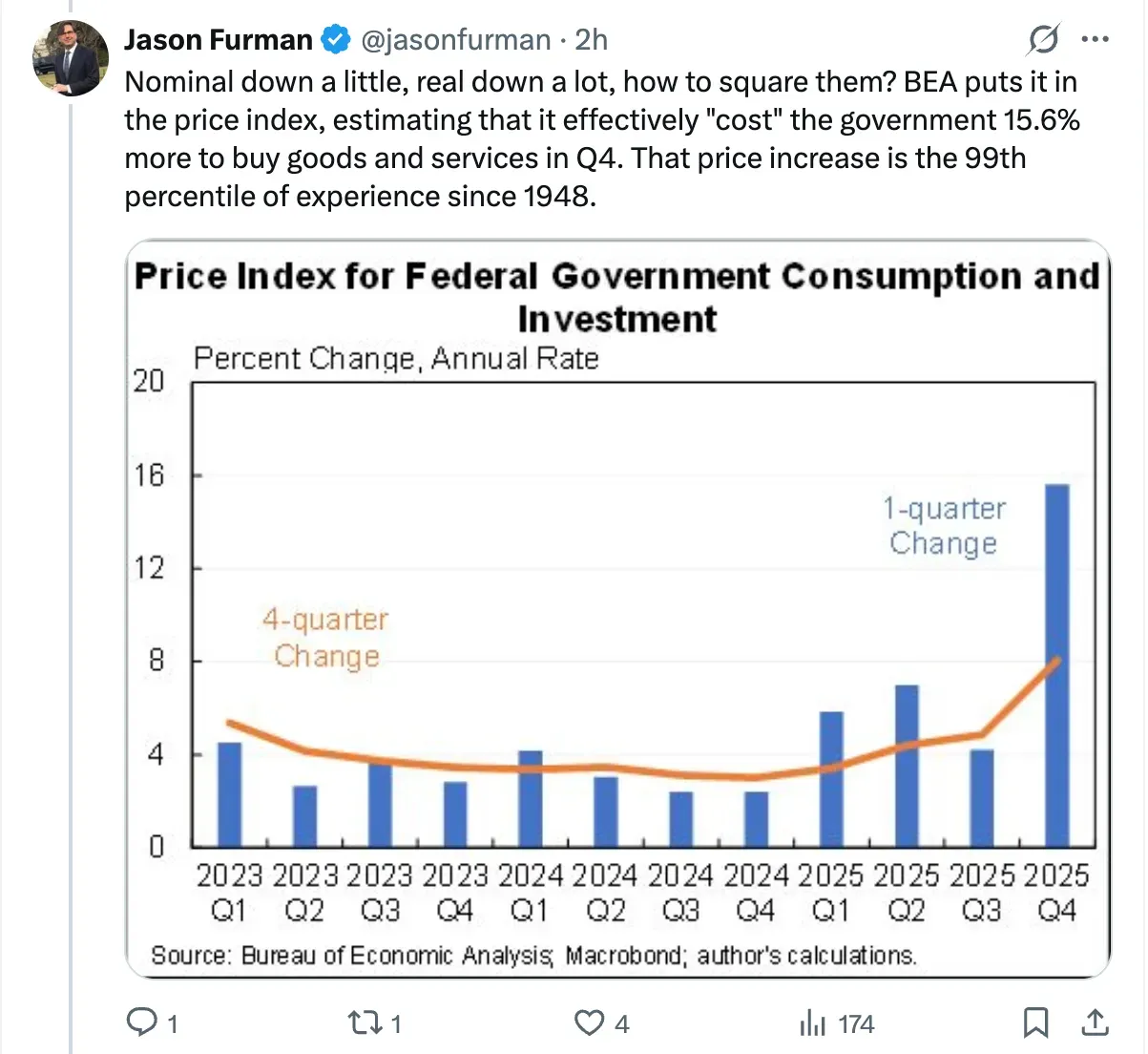

“I’m not sure how much was shutdown vs. durable cuts vs. noise,” he said. Furman said that much of the cut reflected back pay for furloughed workers who were not providing services. He said that the BEA estimated that the federal spending fell at a 16.6% annualized rate, placing the drop in the first percentile of real growth since 1948.

“Nominal down a little, real down a lot, how to square them? BEA puts it in the price index, estimating that it effectively “cost” the government 15.6% more to buy goods and services in Q4,” he said, adding that the differential between federal and overall GDP was the second largest since 1948.

This was what created a notable drag on Q4 GDP, Furman concluded. However, this would result in an artificial growth of about one percentage point in the upcoming quarter “as the govt. snaps back to something more normal in terms of real stuff per dollar.”

Market Reaction

U.S. equities were trading in green on Friday following the U.S. Supreme Court’s decision on Trump tariffs. At the time of writing, the SPDR S&P 500 ETF (SPY), which tracks the S&P 500 index, was up by 0.69%, the Invesco QQQ Trust ETF (QQQ) climbed 0.83%, while the SPDR Dow Jones Industrial Average ETF Trust (DIA) was 0.25% higher.

Retail sentiment around the S&P 500 ETF on Stocktwits was in the ‘bearish’ territory.

The iShares 7-10 Year Treasury Bond ETF (IEF) was down 0.06% at the time of writing, while the iShares 20+ Year Treasury Bond ETF (TLT) was down by 0.26%.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<

Also Read: Google Expands Financing Efforts To Boost AI Chip Sales In Bid To Rival Nvidia: Report