Gauzy postponed its third-quarter results due to the insolvency proceedings against its French units.

- The Commercial Court of Lyon has initiated ‘Redressement Judiciaire’ against the three subsidiaries.

- The stock has recorded its biggest-ever intraday decline on Friday.

- Retail investors shrugged off the setback, turning ‘extremely bullish’ on the ticker, according to Stocktwits data

Shares of Gauzy (GAUZ) plummeted 20% on Friday to a record low after the company disclosed that three of its French subsidiaries have been placed into insolvency proceedings.

This prompted Gauzy to postpone its third-quarter 2025 financial results, which were due on Friday.

Insolvency Proceedings

The Commercial Court of Lyon has initiated “Redressement Judiciaire” a formal French insolvency process, for Gauzy’s three subsidiaries in France.

This procedure typically brings in court-appointed administrators and a creditor representative to oversee operations. Unlike out-of-court restructurings, it introduces significant third-party oversight, which can slow decisions and potentially limit strategic flexibility.

Gauzy said it “strongly disagrees” with the ruling and plans to appeal as soon as possible, while continuing to work with court-appointed administrators to keep operations running normally.

“Over the last three and a half years, Gauzy has invested over $50 million in our people, assets, and operations in France. We fundamentally disagree with this decision, which we believe is unwarranted, and plan to appeal as soon as possible,” said Eyal Peso, Co-founder and CEO.

According to the company’s website, Gauzy Safety Tech and Gauzy Aeronautics are based in Lyon, France.

How Did Stocktwits Users React?

GAUZ stock recorded its biggest-ever intraday drop on Friday. In Friday’s premarket trade, the shares plummeted as much as 50% but later pared most of the losses.

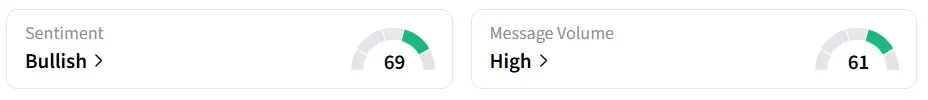

Despite the intraday decline, retail sentiment on Stocktwits turned ‘extremely bullish’ from ‘bullish’ a day earlier, accompanied by ‘extremely high’ message volumes.

One user expects sales for the second half of the year to exceed sales of the first half.

The firm’s third-quarter (Q3) revenue is expected to be $33.79 million, according to Stocktwits data. Last year, the company reported a revenue of $25.67 million.

Year-to-date, the stock has lost 67% of its value.

For updates and corrections, email newsroom[at]stocktwits[dot]com.