Eli Lilly is expanding its U.S. manufacturing footprint with a new Alabama facility that will add thousands of jobs.

- The Huntsville site is expected to create 3,000 construction jobs and employ about 450 people once operational.

- Lilly chose the Greenbrier South location from over 300 proposals for its biotech proximity and infrastructure access.

- The facility will use AI-driven systems and digital tools to support production of “high-quality” medicines.

Eli Lilly (LLY) shares extended their losing streak on Tuesday, slipping for a ninth session, even as the company unveiled a $6 billion-plus manufacturing plan in Alabama.

The stock closed down 1.5% at $982.22 on Tuesday, with the stock edging a further 0.02% lower in after-hours trading at the time of writing.

The site, Lilly’s ninth U.S. manufacturing location announced since 2020, will focus on domestic production of small-molecule synthetic and peptide medicines, including the company’s oral GLP-1 candidate orforglipron.

Details Of The Huntsville Facility

Lilly said the next-generation active pharmaceutical ingredient (API) facility will be its third of four new U.S. manufacturing sites planned and will support future supply of several medicines now in development. The Huntsville facility will be among the sites that manufacture orforglipron, Lilly’s first oral small-molecule GLP-1 receptor agonist, which the company expects to submit for global regulatory review for obesity by the end of this year.

Construction is scheduled to start in 2026 and end in 2032. The company expects to employ around 450 engineers, scientists, operations employees and laboratory technicians and the construction is expected to create about 3,000 jobs.

Lilly estimates each dollar spent in Huntsville can create as much as four dollars of local economic activity. The Greenbrier South site was selected from over 300 applicants in part for its location near HudsonAlpha Institute for Biotechnology as well as access to utilities, transportation and zoning incentives.

Lilly said the new site will use machine learning, AI-enabled systems, advanced analytics and digitally integrated monitoring tools to improve reliability and produce “high-quality” medicines. Digital automation will be incorporated throughout the campus.

US Manufacturing Push Gains More Ground

The Alabama investment follows Lilly’s recent decisions to build new manufacturing sites in Texas and Virginia and expand an existing facility in Puerto Rico. Another U.S. location is expected to be announced in the coming weeks.

The company’s expansion comes as orforglipron continues to produce positive late-stage results. In October, Lilly reported that the oral GLP-1 lowered blood sugar and weight across two Phase 3 trials in type-2 diabetes, outperforming Dapagliflozin in one study and producing additional reductions when combined with insulin glargine in another. Safety and tolerability were consistent with earlier studies. Orforglipron is also being evaluated for obstructive sleep apnea and hypertension in adults with obesity.

How Did Stocktwits Users React?

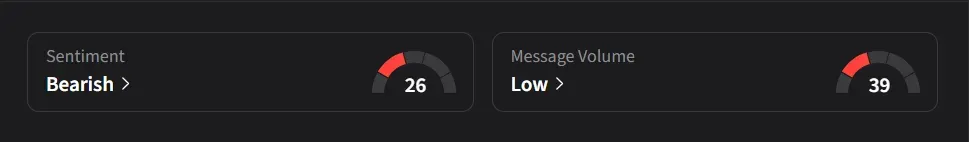

On Stocktwits, retail sentiment for Eli Lilly was ‘bearish’ amid ‘low’ message volume.

One user said, “this is just crazy. It was a series of green even on terrible red days and now series of red. No in between. Too bad the option spead is crazy wild.”

Another user said the stock is “taking after NVO now. RED EVERY DAY.”

Eli Lilly’s stock has risen 28% so far in 2025.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<