Wedbush stated that the addition reflects growing confidence in Unity’s position in gaming and mobile advertising markets and its potential for robust growth.

- Wedbush analyst Alicia Reese stated that Unity is well placed to benefit from rising demand for game engines.

- The firm raised its price target on the stock to $55 from $50.

- Wedbush highlighted continuous improvements in Unity’s core game engine and enhancements to its advertising platform.

Wedbush Securities has issued a positive take on Unity, adding the company to its “Best Ideas” list while raising its 12-month price target to $55 from $50.

The decision reflects growing confidence in Unity’s position in gaming and mobile advertising markets and its potential for robust growth, Wedbush stated, according to TheFly.

The Positives

Wedbush analyst Alicia Reese stated that Unity is well placed to benefit from rising demand for game engines and mobile ads – a combination that could translate into long-term revenue and profit expansion. The firm sees the stock undervalued at current levels, with potential for Unity exceeding consensus estimates on both revenue and earnings.

Wedbush cited continuous improvements in Unity’s core game engine, enhancements to its advertising platform, and the recent rollout of alternative payment systems as key factors that strengthen the company’s growth outlook.

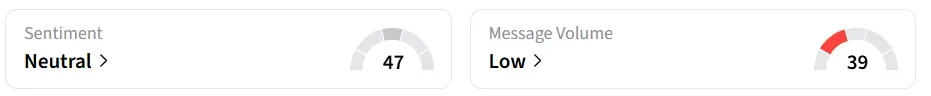

Unity’s stock traded over 3% higher on Tuesday morning. On Stocktwits, retail sentiment around the stock shifted to ‘neutral’ from ‘bearish’ territory the previous day, while message volume shifted to ‘low’ from ‘extremely low’ levels in 24 hours.

Financial Performance

Unity offers a range of tools that help creators build, launch, and expand games and interactive experiences across various platforms, including mobile devices, PCs, and consoles.

In the third quarter, the company’s revenue rose 5% year-on-year (YoY) to $471 million. Adjusted earnings per share (EPS) stood at $0.20. Both revenue and EPS exceeded the analysts’ consensus estimate of $453.06 million and $0.17, respectively, according to Fiscal AI data.

Unity stock has gained over 98% in 2025 and over 84% in the last 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<