After years of slow-walking AI, Apple is reshuffling leadership, leaning on partners, and preparing a Siri overhaul that could ignite its massive device base, just as retail sentiment turns.

- The Siri personal digital assistant (PDA), launched in 2011, was Apple’s first brush with AI.

- Munster sees Subramanya’s hiring as a sign that Apple’s committed to substance behind its AI features.

- The consumer AI market, estimated at $118.65 billion in 2025, will grow at a compounded annual growth rate of 29% to $1.5 trillion by 2035, according to market research.

After ChatGPT’s breakout in early 2023, artificial intelligence (AI) quickly became the industry’s favorite buzzword. Everyone — even the loosely connected — rushed onto the AI bandwagon. Apple, though, held back. The company did make its move, but it remained a cautious adopter.

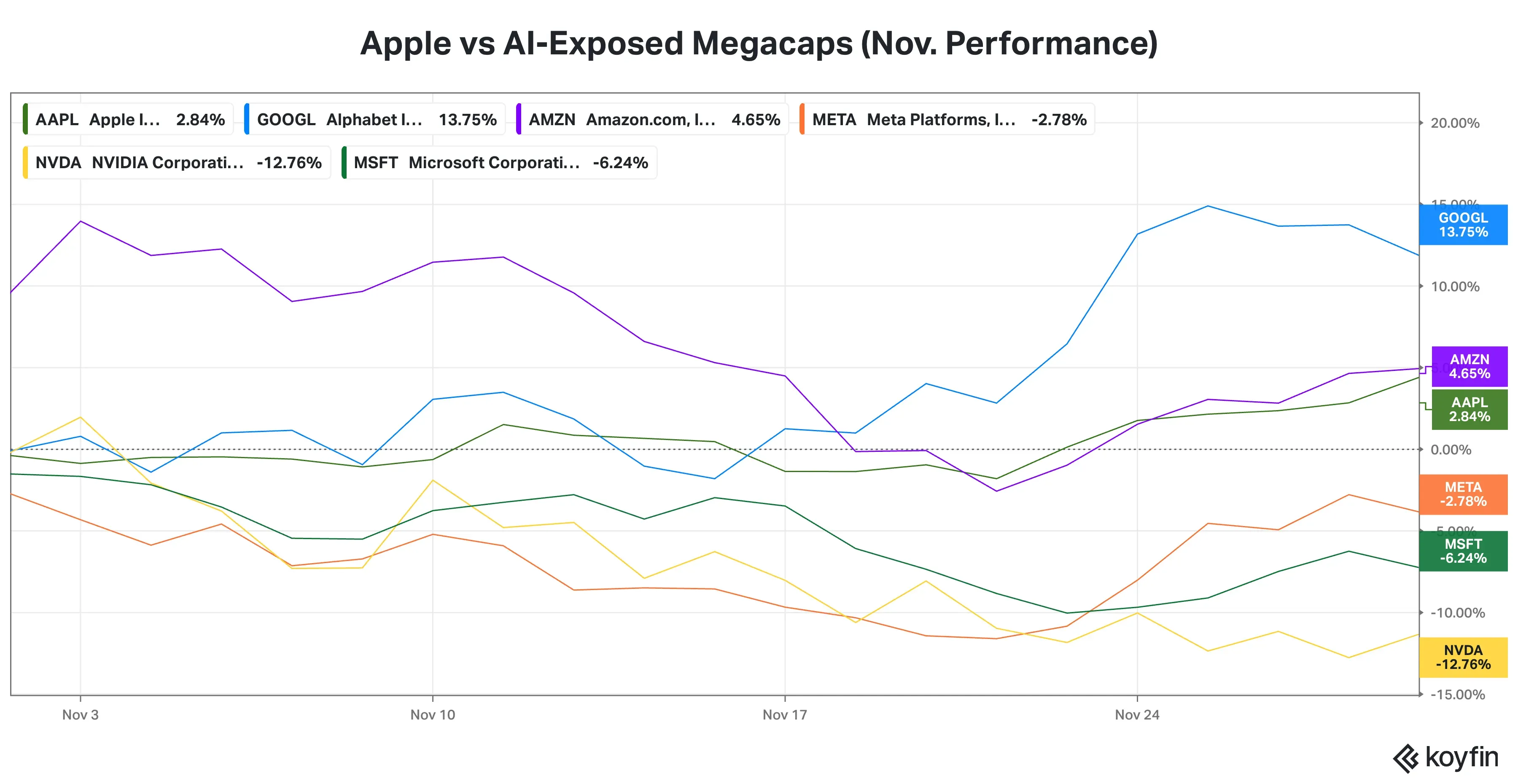

That hesitation turned out to be a blessing in disguise last month as skepticism around AI grew. While AI leaders Nvidia (NVDA) and Meta Platforms (META) slid nearly 3% and 13% in November, Apple’s stock held steady and even rose about 3%. But how much longer can Apple afford to play it safe?

Source: Koyfin<

Cupertino Too Slow On The AI Gun?

Apple, in fact, began its AI pursuits quite early. The Siri personal digital assistant (PDA), launched in 2011, was Apple’s first brush with AI, but rivals now have far superior versions of the same. The company poached Google executive John Giannandrea as its AI head as early as 2018. At Google, Giannandrea was leading Search and AI. When Apple roped him in, top management hoped there would soon be an integrated approach to crack the AI code, but it was not to be. Other tech companies doubled down on their AI efforts, launching breakthrough products and services, but Apple had to be content with rolling out basic AI features.

The Tim Cook-led company unveiled its version of AI, dubbed Apple Intelligence, in June 2024 during the year’s annual Worldwide Developers Conference (WWDC) as a built-in feature of iOS 18, iPadOS 19, and macOS Sequoia. It began rolling out AI features in its flagship product, iPhones, in late 2024, but these were considered very basic compared to the progress peers had made.

A few factors explain the lag. Apple historically tends to wait until others improve a technology, then bring its expertise in design and user-friendliness to the product, according to a Bloomberg report. Also, Apple’s privacy mantra prevents it from building an extensive dataset to effectively train its foundational models.

At WWDC 2024, Apple announced a partnership with OpenAI to integrate ChatGPT into its experiences. In China, the company is teaming with Alibaba to roll out its AI features.

According to Bloomberg’s Mark Gurman, Apple is close to announcing a multi-billion-dollar deal to integrate Google’s Gemini large-language model (LLM) for the overhaul of Siri. Rumors of Apple buying Perplexity also circulated at one point.

On Apple’s fourth-quarter earnings call, when Apple was asked about capital expenditure on data centers, CFO Kevan Parekh said, “I don’t see us moving away from this hybrid model where we leverage both first-party capacity as well as leverage third-party capacity.”

Apple’s Massive Consumer AI Opportunity

Apple has a massive installed base of active devices, including iPhones. iPhone sales growth has stagnated due to a tepid demand outlook amid macroeconomic travails, the company’s travails in China amid the country’s standoff with the U.S., and the lack of meaningful upgrades. The integration of AI is widely seen as a key factor in kickstarting new adoption and upgrades.

According to Future Market Insights, the consumer AI market, estimated at $118.65 billion in 2025, will grow at a compounded annual growth rate of 29% to $1.5 trillion by 2035. “The market’s expansion is fueled by rising consumer demand for personalized, efficient, and intuitive solutions that streamline tasks and improve convenience,” the firm said.

Is Apple Remedying Its Pitfall?

After a long delay, Apple could be closing in on the launch of its AI-powered Siri as early as next year, giving a thrust to all its hardware products.

After Giannandrea’s eight-year stint failed to yield the desired results, the company is looking elsewhere to spearhead its AI efforts. The company announced Monday that the executive will step down as SVP of Machine Learning and AI strategy after a transition period and named Microsoft’s AI chief, Amar Subramanya, as his replacement. The new hire, while reporting to SVP, Software Engineer Craig Federighi, will lead critical areas, including Apple Foundation Models, ML research, and AI Safety and Evaluation.

Subramanya’s LinkedIn profile shows he has a doctoral degree from the University of Washington. After a 16-year stint at Google, he joined Microsoft as Corporate VP, AI, in July this year.

Deepwater Asset Management’s Gene Munster sees the executive change as a signal that the new Siri is on track for a Spring release. He also believes Giannandrea may have asked to retire, given he still has five good years left by Apple’s standards. “Shows Cook is serious about having substance behind their AI features,” he added.

AAPL Bracing For Year-end Run?

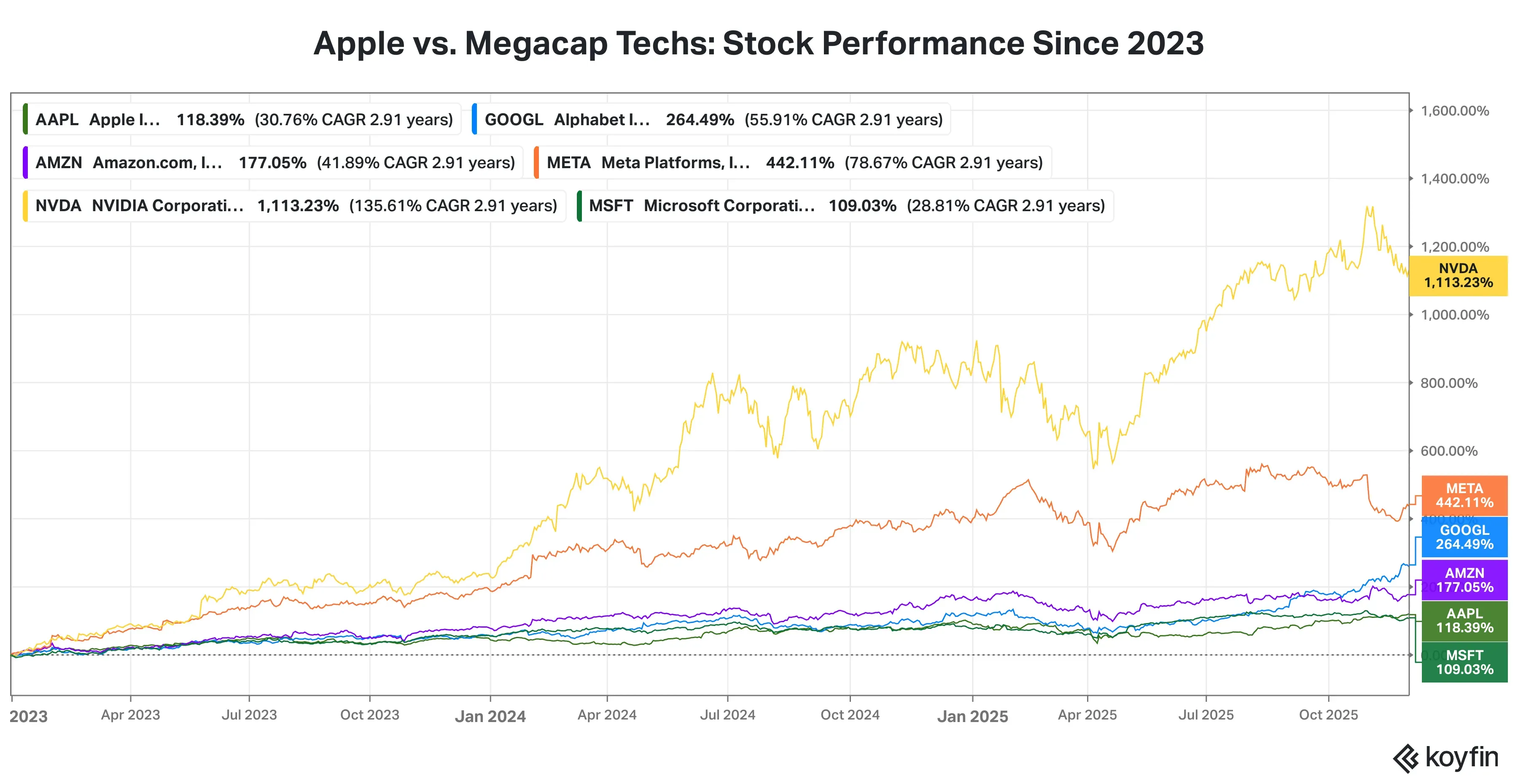

On Monday, Apple stock climbed 1.53%, belying the broader market pullback. The stock has been setting fresh peaks, aligning with the typicality of a run into the year-end. The stock’s gain since the AI mania began in 2023 pales in comparison to its megacap tech peers, except Microsoft.

Source: Koyfin<

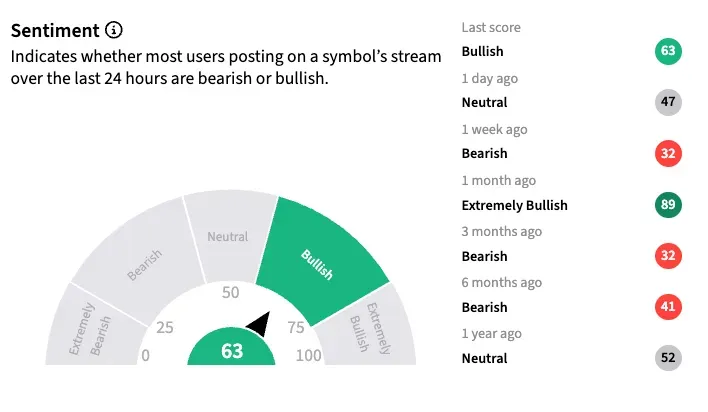

Apple retail traders have slowly begun warming to the stock, with the sentiment meter on Stocktwits platforms showing a reading consistent with a ‘bullish’ mood, an improvement from the bearish sentiment seen for much of the year.

The analysts’ average stock price target for the stock ($281.75) implied less than 1% upside following its recent run. Of the 48 analysts covering the stock, 29 rate Apple either as ‘Strong Buy’ or ‘Buy,’ and 15 remain on the sidelines. The stock has a sell call from four analysts.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<