On Thursday, the Dow Jones Industrial Average index plummeted by approximately 800 points, marking the index’s worst performance since October 10.

- While the broader market showed signs of strain, the more speculative names within the meme stock space struggled, with some of the biggest names in the industry enduring massive losses.

- Roundhill Investments’ Meme Stock ETF (MEME) was poised to end the week down 12%.

- Rigetti, D-Wave Quantum, and IonQ faced declines of over 25%.

Meme stocks have reportedly taken a significant hit this week amid a challenging period for major U.S. indices.

While the broader market showed signs of strain, the more speculative names within the meme stock space struggled, with some of the biggest names in the industry enduring massive losses.

Meme Stocks Struggle

On Thursday, the Dow Jones Industrial Average index plummeted by approximately 800 points. This marked the index’s worst performance since October 10.

Meanwhile, meme stocks, a popular but volatile category of assets, are facing steeper losses. Roundhill Investments’ Meme Stock ETF (MEME) was poised to end the week down 12%, according to data reported by CNBC.

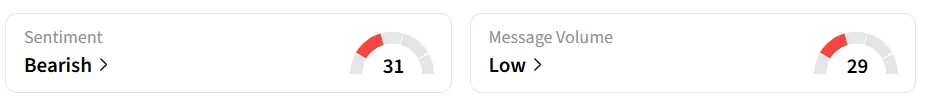

On Stocktwits, retail sentiment around MEME ETF remained in ‘bearish’ territory amid ‘low’ message volume levels.

Meme stocks are shares that experience a surge in trading activity and a sharp price increase after gaining popularity on social media.

Biggest Losers In Meme Stock Space

Several stocks in the ETF have experienced significant declines this week, with quantum computing companies such as Rigetti Computing Inc. (RGTI), D-Wave Quantum Inc. (QBTS), and IonQ Inc. (IONQ) each facing declines of over 24%.

Other prominent meme stocks, such as NuScale Power Corp. (SMR) and Beyond Meat, Inc. (BYND), have also experienced severe pullbacks, losing 48% and 39%, respectively, over the week.

According to a CNBC report, Investor Peter Boockvar, Chief Investment Officer at One Point BFG Wealth Partners, attributed the sell-off to a broader market retreat in speculative generative AI stocks, according to the report.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<