The selloff comes as blarcamesine completed its oral explanation during the EMA’s Nov. 10–13 review window.

- The selloff comes as blarcamesine completed its oral explanation during the EMA’s Nov. 10–13 review window.

- The therapy reached this stage after progressing through the Day-120 and Day-180 questions earlier this year.

- Investors are watching for any CHMP update following recent data showing a slowing of cognitive decline.

Anavex Life Sciences shares posted their steepest single-day drop in nearly two years on Thursday as investors braced for a key regulatory moment in Europe for its Alzheimer’s drug candidate, blarcamesine. The selloff comes as the therapy completed Oral Explanation Week at the European Medicines Agency (EMA), a step that typically signals regulators have unresolved questions late in the review.

Blarcamesine Completes EMA Oral Review Week

The Committee for Medicinal Products for Human Use, or CHMP, placed blarcamesine on its agenda for oral explanations and regulatory review during the session scheduled from Nov. 10 to Nov.13, with the oral explanation held behind closed doors on Nov. 11. Oral explanations are not standard for smooth applications and they appear only when CHMP wants direct clarification before issuing an opinion, according to a report by Seeking Alpha.

The drug’s EU dossier has progressed through the formal review stages over the past year, with Day-120 questions in April and Day-180 outstanding issues in September, at which point the CHMP noted that major objections remained. With the November session now concluded, investors are watching for any outcome in the committee’s published meeting highlights.

Recent Clinical Signals Added To Investor Focus

In September, Anavex reported new clinical findings showing cognitive stabilization over 48 weeks in a precision-medicine subgroup of patients with early Alzheimer’s disease. Participants taking 30 mg once daily blarcamesine showed barely detectable cognitive decline across standard Alzheimer’s scales, and the company said the drug produced an 84.7% reduction in decline versus placebo on one neuropsychological test.

The company is also testing blarcamesine in Parkinson’s disease dementia and Rett syndrome, expanding its pipeline beyond Alzheimer’s.

Analysts Still See A Possible Path To Conditional Approval

A report last month from Spirit of the Coast Analytics said blarcamesine remains a candidate for conditional approval, noting that the Phase 2b/3 study had a modest sample size and missed one co-primary endpoint but showed statistically strong results on other measures, with supporting long-term durability data. The report highlighted that the EMA often opts for conditional approval for diseases with major unmet needs when safety is favorable.

Stocktwits Users Debate Path Forward

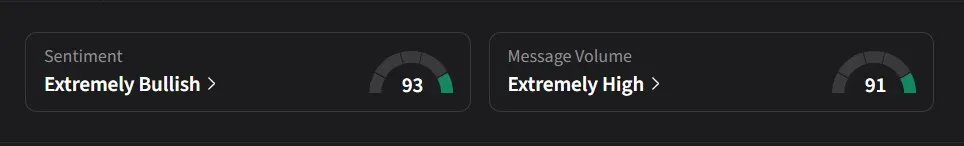

On Stocktwits, retail sentiment for Anavex was ‘extremely bullish’ amid a 137% jump in 24-hour message volume.

One Stocktwits user argued that blarcamesine has an underappreciated advantage because it targets the same biological pathway that has long been pursued in the longevity and biohacking spaces, citing fasting, rapamycin, and other autophagy-related interventions. They suggested that the missed co-primary endpoint could still lead to conditional marketing authorization, with a follow-up trial reinforcing the outcome.

Another user said, “I think there is a 40% chance of an opinion, 60% chance we, among some others, are not mentioned at all.”

A third user said, “Actually, rejection is easy, EMA had everything they needed, it would have been very easy for them just looking at data and they would have said no before oral explanation. SO THERE IS ONLY ONE OPTION LEFT::APPROVAL.”

Anavex’s stock has declined 33% so far in 2025.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<