The company’s shares declined marginally after the announcement, while Stocktwits sentiment rose.

- Under Armour announced that it is ending its partnership with NBA star Stephen Curry as part of an internal restructuring.

- Under Armour, which signed Curry in 2013, offers a line of his signature sneakers and apparel.

- The company’s shares declined marginally after the announcement, while Stocktwits sentiment rose.

Under Armour, Inc. on Thursday said it is parting ways with NBA star Stephen Curry after a partnership of more than 10 years, as part of an internal restructuring to focus on its core brand and products. The company also raised its projection of reconstruction costs.

Curry signed with Under Armour after his contract with Nike, Inc. expired in 2013, and in 2020 created the “Curry Brand” within Under Armour, selling a line of signature basketball sneakers and apparel under the brand name.

Following the split, Curry Brand will become an independent entity. Under Armour will still release the Curry 13, the final Curry Brand and Under Armour shoe, in February, with additional colorways and apparel collections available through October.

Dropping the Curry partnership will add $95 million to restructuring costs, the company said, bringing the total to $255 million through fiscal year 2025.

The development comes amid prolonged weakness in Under Armour’s business, driven by softer demand for premium sportswear and by rising competition from challenger brands such as On Holdings and Alo Yoga, in a market long dominated by giants such as Nike and Adidas.

“For Under Armour, this moment is about discipline and focus on the core UA brand during a critical stage of our turnaround. And for Stephen, it’s the right moment to let what we created evolve on his terms,” CEO Kevin Plank said in a statement.

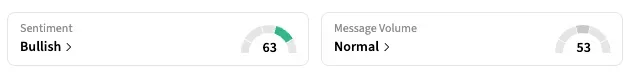

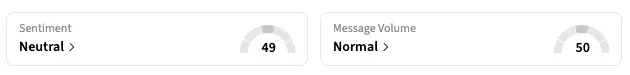

Under Armour’s Class C shares declined 0.2% in after-hours on Thursday after losing over 2% in the regular session. On Stocktwits, the retail sentiment for the company’s class A shares shifted to ‘bullish’ from ‘neutral,’ and that for the class C shares shifted to ‘neutral’ from ‘bearish.’

Several users viewed the news as a positive development for the company and as potentially an opportunity to add a position, especially given Under Armour’s shares trading at all-time lows.

“$UAA Bought 1000 more,” said one user, while another said they added the stock to their Stocktwits watchlist.

A user blamed CEO Kevin Plank for the company lagging behind the competition. “Steph Curry couldn’t sell water to a thirsty person! Kevin Plank needs to go, learn from $ONON,” they said.

Last week, Under Armour issued a weak annual sales and profit forecast and announced the appointment of Samsonite CFO Reza Taleghani as the sportswear company’s next finance chief. The company swung to a loss in its latest quarter as revenue fell 5%.

As of the last close, UAA stock has declined nearly 44% year to date.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<