Officials are also said to be exploring limits on index-fund giants like BlackRock, Vanguard, and State Street to reduce their sway in corporate voting.

- The White House is reportedly drafting an executive order to restrict proxy-advisory firms such as ISS and Glass Lewis from issuing or profiting from voting recommendations.

- The move follows Musk’s criticism after both firms advised against his $1 trillion Tesla pay package, which shareholders ultimately approved.

- Officials are also said to be exploring limits on index-fund giants like BlackRock, Vanguard, and State Street to reduce their sway in corporate voting.

Tesla, Inc. has become a flashpoint in Washington’s growing scrutiny of proxy-advisory firms and index-fund giants after CEO Elon Musk’s repeated criticism of Institutional Shareholder Services and Glass Lewis.

The White House is reportedly weighing measures to curb the power of these firms, whose recommendations influenced, but ultimately failed to sway, the landmark shareholder vote on Musk’s $1 trillion pay package, according to a report by The Wall Street Journal.

Musk’s Clash With Proxy Advisers Sparks Policy Push

Tesla’s showdown with ISS and Glass Lewis over Elon Musk’s compensation plan has spilled into the political arena. Both firms had urged investors to vote against Musk’s record $1 trillion pay package, arguing it was excessive. However, the recommendation was rejected by shareholders last week.

Musk accused the firms of acting like “corporate terrorists” who interfere with shareholder democracy. He claimed their recommendations distort corporate governance and empower unelected intermediaries over actual investors. His complaints have now found an audience in Washington, where the Trump administration is reportedly drafting new restrictions on the proxy-advisory industry.

White House Reportedly Weighs Limits On Proxy Firms And Fund Giants

The White House is reportedly preparing an executive order that would restrict proxy-advisory firms such as ISS and Glass Lewis from making voting recommendations on companies that also pay them for consulting work, or possibly bar such recommendations altogether.

Officials are also said to be exploring limits on index-fund managers including BlackRock, Vanguard, and State Street, which collectively control about 30% of shares in many major U.S. companies. One proposal would require these firms to mirror client votes when investors choose to cast their own ballots, reducing their concentration of influence.

If adopted, the measures would align closely with Musk’s long-standing criticism of proxy advisers and large asset managers, which he says hold too much sway over boardroom decisions. JPMorgan Chase CEO Jamie Dimon has also voiced similar concerns, calling proxy advisers conflicted and overly powerful.

ISS And Glass Lewis Defend Their Role

ISS said it operates under SEC regulation as a registered investment adviser and “is proud of its history of providing independent, objective advice.” Glass Lewis said it supports addressing potential conflicts “through regulation rather than executive orders” and plans to end its broad “benchmark” voting recommendations by 2027 in favor of more tailored guidance.

Both firms have maintained that they provide analysis to help investors make informed decisions, while final voting authority rests with shareholders.

Stocktwits Users Show ‘Extremely Bullish’ Mood

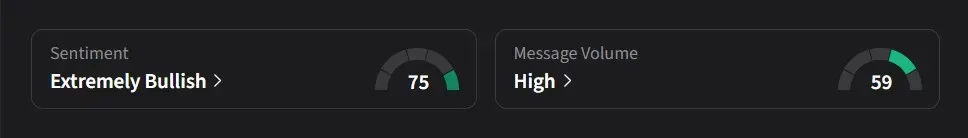

On Stocktwits, retail sentiment for Tesla was ‘extremely bullish’ amid ‘high’ message volume.

Tesla’s stock has risen 9% so far in 2025.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<