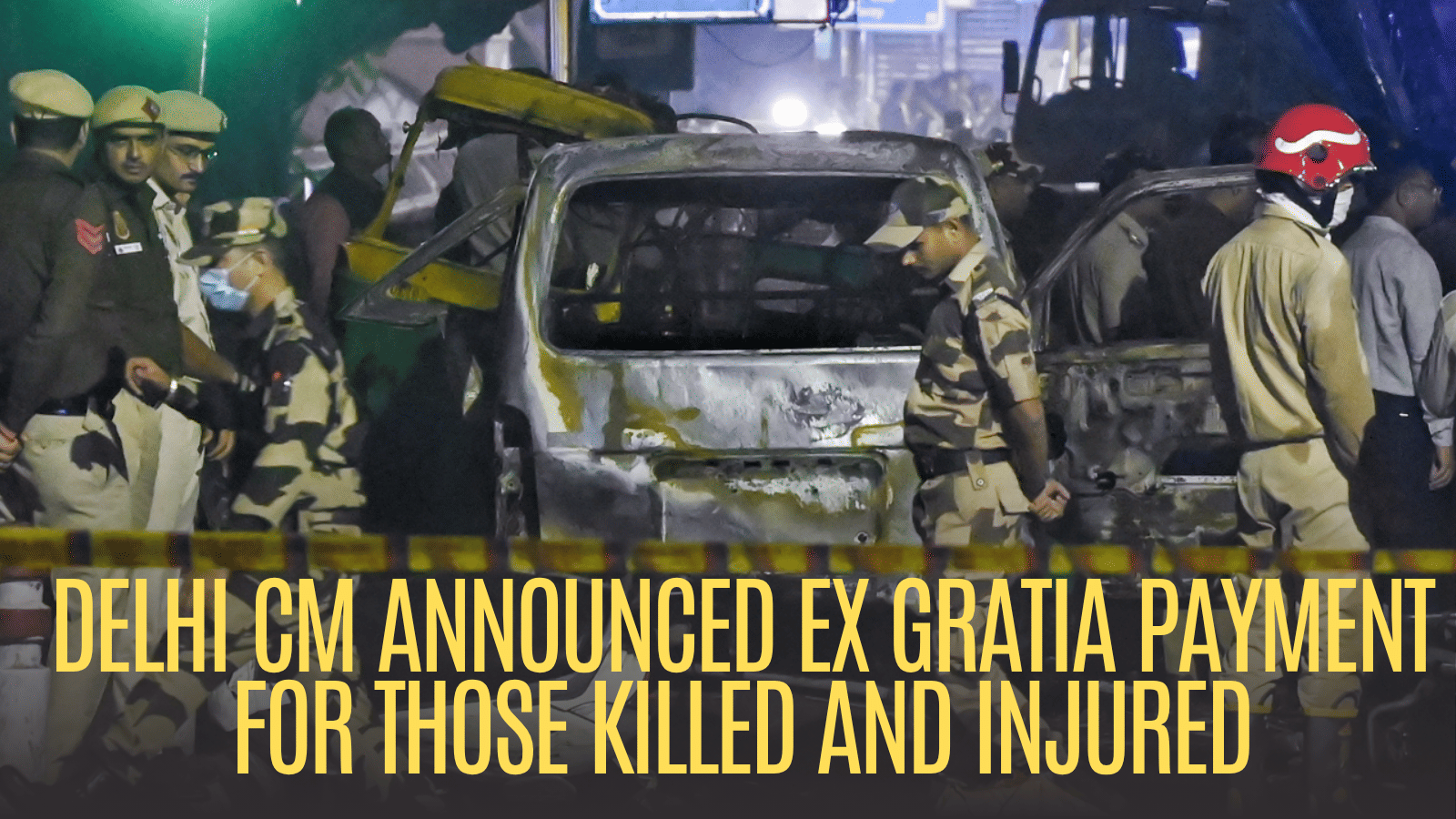

Kolkata: The explosion in front of Red Fort metro station in the national capital in the evening of November 100, stunned the nation. Delhi chief minister Rekha Gupta has made an announcement that Rs 10 lakh will be paid as an ex gratia amount to the families of those who lost their lives in the terror strike. On the other hand, those who will suffer permanent disabilities will get Rs 5 lakh. Rs 2 lakh will be paid to anyone with serious injuries from the blast. Everyone with injuries will get medical treatment at the expense of the government, she has said.

A pertinent question that will arise against the backdrop of the announcement of New Delhi chief minister is, will the amounts that the government gives as ex gratia to the families of those killed and those with injuries and disabilities attract taxes? If so, how will it be computed and what will be the amount. Ex gratia payments are typically announced by governments for relief following accidents or tragic incidents to provide immediate financial support. It should also be mentioned that the very nomenclature suggests that such payment is made as a gesture of support and the body paying the money is under no obligation to do so.

Tax experts have told the media that provisions in the Income-tax Act state that only revenue receipts are usually taxable but capital receipts are not. They become taxable only when such payments are specifically brought under the scope of taxation by the Income Tax Act.

“The Rs 10 lakh ex gratia announced by the Delhi Chief Minister for the families of the Red Fort car blast victims is in the nature of a capital receipt, as it represents a compassionate payment made by the State Government to provide relief for loss of life in a tragic incident. It is neither a payment for any services rendered nor a consideration for any business or profession carried on by the recipient. Accordingly, the Rs 10 lakh received by each family is not taxable, and not required to be disclosed in the income tax return,” said Himank Singla, founding partner, SBHS & Associates, was quoted in the media as saying.

Tax veteran Balwant Jain also told the media that “It is not taxable. It is exempt under Section 10(BC) of the Income Tax Act, provided it qualifies as a disaster under the Disaster Management Act, 2005,” said Jain.