The Future Fund’s Gary Black said over 70% of Tesla’s profits still come from EVs, not autonomy or robotics.

- The Future Fund’s Gary Black said over 70% of Tesla’s profits still come from EVs, not autonomy or robotics.

- Tesla launched a short-term U.S. rental program as sales slowed following the end of the federal EV tax credit.

- CEO Elon Musk renewed the Cybertruck promotion amid key executives’ departures, and recalls added pressure.

Tesla, Inc. shares fell by more than 1% on Tuesday and slipped further after hours. The Future Fund’s Gary Black renewed a warning that the company’s lofty 200x valuation rests on a “fool’s narrative” around robots and autonomy. His remarks come as Tesla launches a U.S. rental program to address slumping EV demand, faces executive exits, and CEO Elon Musk revives Cybertruck promotion.

Gary Black Renews Valuation Critique

The Future Fund’s Managing Partner, Gary Black, reiterated his bearish stance on Tesla’s valuation, calling investor faith in its robot and autonomy roadmap a “fool’s narrative” given that more than 70% of Tesla’s profits still come from electric vehicles.

“Tesla bulls say it doesn’t matter that Tesla October global volumes are down 30–35% year over year since the business is transitioning to unsupervised autonomy and humanoid robots. That’s a fool’s narrative,” Black wrote on X.

He argued that while Tesla once had a first-mover advantage with highly profitable EVs, “nobody else except BYD has made money on EVs,” and Tesla’s edge has narrowed. Black said fully autonomous ride-hailing is a commodity business where Chinese manufacturers like Baidu, Pony.ai, and WeRide already complete around 450,000 paid fully autonomous rides each week and plan to license their technology broadly.

“I have said for years that unsupervised autonomy is table stakes for anyone in the automotive business, and that prediction looks more prescient every day,” Black added, noting that few Wall Street models project meaningful profits from autonomous ride-hailing or humanoid robots. “It’s hilarious that Tesla bulls cheerlead without even attempting to justify Tesla’s valuation.”

Black concluded that Tesla’s 200x forward price-to-earnings ratio is “difficult to justify in what is clearly a commodity business… where Tesla is one of many fighting for market share.”

Tesla Turns To Rentals As US Sales Slide

Amid a sharp slowdown in U.S. demand following the end of the federal EV tax credit, Tesla has launched a new short-term rental program at select stores. The initiative lets customers rent vehicles for three to seven days at rates starting at $60 per day, including free Supercharging and access to Full Self-Driving (Supervised), according to an Electrek report.

Tesla said renters who order a car within seven days of their rental will receive a $250 purchase credit. The program, currently available in Southern California, is expected to expand nationwide before year-end.

Cybertruck, Executive Exits Add Pressure

CEO Elon Musk on Tuesday took to X to renew enthusiasm for the Cybertruck, replying to users defending the vehicle as Tesla’s “best” model. Musk responded to one owner, “Cybertruck is awesome,” and agreed with another who said it was “the best Tesla,” replying, “true.”

The renewed promotion follows a wave of challenges for the stainless-steel pickup — including recalls, lawsuits, and key personnel exits. Cybertruck program manager Siddhant Awasthi and Model Y program manager Emmanuel Lamacchia both announced their departures from Tesla this week.

In late October, Tesla recalled about 6,200 Cybertrucks, roughly 10% of all units sold, over a faulty adhesive in the off-road light bar, while lawsuits have alleged door handle defects in fatal accidents.

Product Refresh

Tesla’s Model Y remains its best-selling vehicle, accounting for most of the company’s 481,166 combined deliveries of Model 3 and Model Y units in the third quarter. The automaker has launched refreshed versions and new trims of the Model Y in China and the U.S. to maintain momentum amid an aging lineup.

At Tesla’s annual shareholder meeting last week, Musk said the company plans to begin production of the Tesla Semi, the Optimus humanoid robot, and the Cybercab robotaxi in 2026, signaling a pivot toward new products and automation.

Stocktwits Users See Tesla As Long-Term Holding

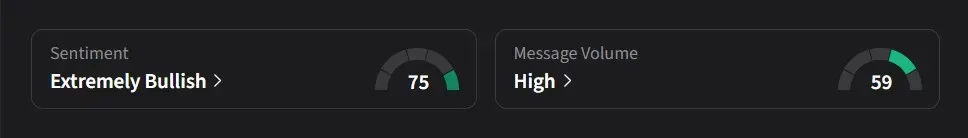

On Stocktwits, retail sentiment for Tesla was ‘extremely bullish’ amid ‘high’ message volume.

One user described Tesla as a long-term holding for pension and ETF portfolios but advised traders to “take your profits” in the short term while staying invested for the long haul.

Another user compared the current negativity around Tesla to how the media once criticized Amazon years ago, saying analysts “never apologize” and that negative news sells more because most people enjoy it.

Tesla’s stock has risen 9% so far in 2025.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<